For years, I bounced between budgeting methods that never seemed to stick. Traditional budgets felt too loose, while percentage-based systems boxed me in. Every month ended with the same question: Where did my money go? Then I stumbled onto zero-based budgeting, and everything shifted.

Zero-based budgeting means you give every dollar of your income a specific job until you have zero dollars left to budget. This approach uses a simple formula: Income minus expenses equals zero.

Every dollar gets assigned, whether it’s for bills, savings, or even your favorite coffee runs. What finally made budgeting click for me was the intentionality this method demands. Instead of hoping my spending worked out, I started each month with a plan.

My financial stress eased, my savings grew, and—surprisingly—I began to enjoy budgeting.

Key Takeaways

- Zero-based budgeting gives every dollar a purpose until income minus expenses equals zero.

- You gain complete control by planning where your money goes before you spend it.

- Regular tracking and adjustments are necessary, but the intentional approach removes financial guesswork.

What Is Zero-Based Budgeting and Why It Works

Zero-based budgeting asks you to start from scratch each month. You assign every dollar of income to a category, beginning at zero. Unlike traditional budgets, this method requires you to justify each expense instead of repeating old habits.

Defining Zero-Based Budgeting

With zero-based budgeting, you allocate your entire monthly income to expenses, savings, and debt payments until you reach zero. This doesn’t mean you spend it all. Instead, you plan for each dollar before the month starts.

I use categories like:

- Fixed expenses (rent, insurance)

- Variable costs (groceries, gas)

- Savings goals

- Debt payments

- Fun money

Planning where every dollar goes gives you total financial awareness.

Money no longer sits unassigned in my checking account. Zero-based budgeting pushes me to make intentional choices about my spending priorities.

How Zero-Based Budgeting Differs from Traditional Budgeting

Traditional budgeting usually repeats last month’s spending, making only small tweaks. Zero-based budgeting starts fresh. I justify every expense, refusing to let old patterns dictate my financial future.

Here’s a quick comparison:

| Traditional Budgeting | Zero-Based Budgeting |

|---|---|

| Builds on past spending | Starts from zero |

| Adjusts previous budgets | Justifies each expense |

| Leaves money unassigned | Assigns every dollar |

| Less detailed planning | Requires complete planning |

This approach improved my financial literacy. I finally understood where my money was going.

Key Principles Behind Zero-Based Budgeting

Intentional allocation comes first. Every dollar gets a purpose before I spend it, which stops mindless purchases. Next is the monthly reset. Each month, I review my needs and goals, not just repeat past habits.

The third principle is complete accountability. When income minus expenses equals zero, I know where every dollar lands. This method removes guesswork. I can’t overspend in one category without adjusting another, which helps me stick to my goals.

Step-By-Step Guide: Building Your Zero-Based Budget

Creating a zero-based budget means assigning every dollar a specific job before you spend it. You track all your income and expenses, making sure income minus expenses equals exactly zero.

Listing All Income Sources

Start by listing every way money comes into your home each month. Your income isn’t just your main job’s paycheck. Include your salary after taxes. Count side hustle earnings, freelance gigs, or part-time work.

Don’t forget these:

- Rental property income

- Investment dividends

- Child support or alimony

- Social Security benefits

- Pension payments

- Regular gift money

If your income changes monthly, use the lowest amount you expect. This keeps your budget realistic.

I learned this the hard way. I once budgeted based on my highest month and ended up overspending when my income dropped.

Identifying Fixed and Variable Expenses

Fixed expenses stay the same each month. Variable expenses change based on your choices.

Fixed expenses:

- Rent or mortgage

- Insurance premiums

- Loan payments

- Phone bills

- Streaming services

Variable expenses:

- Groceries

- Gas

- Dining out

- Entertainment

- Clothing

Review three months of bank statements to find your average spending. This gives you a solid starting point. Remember irregular expenses, like car registration or holiday gifts. Divide these yearly costs by 12 and set that amount aside monthly.

This strategy keeps surprises from blowing up your budget.

Allocating Every Dollar Intentionally

Now, assign every dollar of income to a category until you reach zero. Start with essentials: housing, utilities, minimum debt payments, and transportation.

Next, plan for groceries and basic clothing. Then, fund your financial goals like emergency savings or debt payoff.

My priority order:

- Housing and utilities

- Food and transportation

- Minimum debt payments

- Emergency fund

- Other savings

- Entertainment and extras

If expenses exceed income, cut back on variable costs first.

If you have money left after covering everything, assign it to debt payoff, savings, or other goals.

Tracking and Adjusting Your Budget

Your budget only works if you track spending and compare it to your plan. Check in weekly to see where you stand. I use a simple spreadsheet, but you can use apps or even paper. The key is staying consistent.

If you overspend in one category, move money from another. For example, if you spend $50 extra on groceries, take $50 from entertainment. Adjust your budget as you learn your real spending habits. It may take a few months to get it right.

When your income or expenses change, update your budget. Life happens—your budget should adapt.

Zero-Based Budgeting in Action: Benefits and Challenges

Zero-based budgeting changed how I approach money. Each month, I evaluate every expense from scratch. This method boosted my financial awareness and helped me hit my goals, even though it took some getting used to.

Enhancing Financial Awareness and Money Management

Zero-based budgeting opened my eyes to where my money actually goes. I now separate groceries from restaurant spending, instead of lumping them together as “food.”

Assigning every dollar before spending stops impulse buys.

Here’s what changed for me:

- I see my spending patterns clearly.

- I understand my needs versus wants.

- I’m more mindful about financial decisions.

- I regularly review subscriptions and recurring costs.

My financial literacy improved because I had to research and justify every expense. When planning for long-term goals, I learned about different investment options.

The monthly reset keeps me engaged. Budgeting now feels like strategic planning, not a chore.

Achieving Savings and Financial Goals

Zero-based budgeting helped me reach savings goals by making them a priority.

I assign a fixed amount to savings each month, treating it like a bill.

How I hit my goals:

- Set specific amounts for each goal.

- Treat savings as non-negotiable.

- Track progress weekly.

- Adjust other categories if needed.

I’ve saved for a new car, vacation, and home repairs this way. Breaking big goals into monthly pieces makes them manageable. A $6,000 emergency fund feels less daunting as $500 a month.

When I can’t fund every goal, I choose based on what matters most.

Handling Debt Payments and Emergency Fund

Zero-based budgeting made me tackle debt head-on. I treat debt payments as fixed expenses that get funded first.

By cutting spending leaks, I increased my debt payments by 40%.

My debt strategy:

- List debts with minimum payments.

- Add extra payments as line items.

- Fund debt before discretionary spending.

- Use leftover money for more debt reduction.

I also made emergency fund contributions a must-have, not an afterthought.

Each category has boundaries, so I don’t rob savings to cover overspending. Having both debt payments and emergency savings in my budget gives me peace of mind.

Common Pitfalls and Learning Curve

The biggest challenge is the time investment. Starting from zero takes a couple of hours at first.

I made mistakes—like forgetting irregular expenses—that threw off my budget.

What I learned:

- Don’t set unrealistic amounts.

- Remember seasonal expenses.

- Stay flexible with categories.

- Track spending all month.

Trying to track too many categories at once overwhelmed me. I started broad, then got more detailed as I learned.

Consistency is key. I check in regularly and adjust as needed.

After several months of trial and error, I found a system that fits my life.

Tools, Apps, and Tips to Succeed with Zero-Based Budgeting

The right tools and habits make zero-based budgeting easier. Choosing a good app, checking in monthly, and building smart routines helped me avoid common mistakes.

Choosing the Right Budgeting App or System

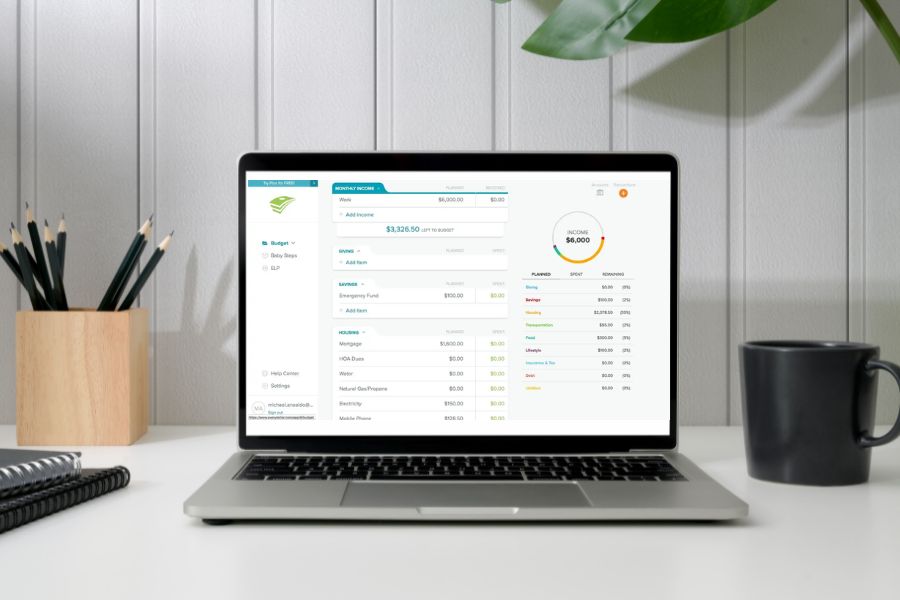

I’ve tested many budgeting apps. The best ones for zero-based budgeting let you assign every dollar before spending. EveryDollar is great for beginners. It’s built for zero-based budgeting and has a simple interface.

YNAB (You Need A Budget) offers advanced features and makes you give every dollar a job. Goodbudget uses the envelope method and works well for this style. You set up digital envelopes for each category.

Prefer spreadsheets? Start simple: list income at the top, subtract each category, and make sure you hit zero.

| App Type | Best For | Monthly Cost |

|---|---|---|

| EveryDollar | Beginners | Free or $17.99 |

| YNAB | Advanced users | $14 |

| Goodbudget | Envelope method | Free or $10 |

| Spreadsheet | DIY approach | Free |

Pick one system and stick with it for at least three months. That’s when the magic starts to happen.

Keeping Up with Monthly Reviews and Adjustments

I schedule my budget review for the same day each month. This routine helps me spot problems early and stay on track.

Set a monthly budget meeting with yourself. I do mine on the 28th of each month for the following month. Block 30 minutes on your calendar to make it official. Review last month’s spending first. Check where you went over budget and figure out why.

I keep notes about unexpected expenses. This way, planning for next month becomes much easier. Adjust categories based on what you learned. If you always overspend on groceries, increase that category and cut back elsewhere.

Plan for upcoming expenses by checking your calendar. Birthdays, car maintenance, and other one-off costs shouldn’t catch you off guard.

Here’s my simple monthly checklist:

- Review all spending from last month

- Note any budget categories that were too high or low

- Update amounts for next month

- Plan for known upcoming expenses

- Assign every dollar until income minus expenses equals zero

This monthly habit keeps small budget problems from turning into big financial headaches.

Maximizing Efficiency and Preventing Overspending

Smart systems stop overspending before it starts. I’ve learned that relying on willpower alone rarely works. Use the cash envelope method for discretionary spending. Take out cash for things like entertainment, dining out, and shopping. When the envelope is empty, spending stops.

Set up automatic transfers on payday. Move money to savings and bill accounts right away to remove temptation. Check your budgeting app daily. I spend two minutes each morning reviewing my balances, which keeps my spending top of mind.

Create spending speed bumps. Remove saved payment methods from online stores and add a 24-hour wait rule for purchases over $50. Track discretionary spending in real-time. These flexible categories often cause the most trouble, so I update my app right after each purchase.

Keep a small “miscellaneous” category for unexpected costs. This stops one surprise expense from derailing your entire budget.

Building these habits makes staying on budget feel automatic, not stressful.

Frequently Asked Questions

Zero-based budgeting raises lots of questions. Here are clear answers to the most common concerns.

What are the key steps to creating an effective zero-based budget?

Start by listing your monthly income. Every dollar should have a specific job before you spend it. Write down all necessary expenses, like rent, utilities, groceries, and debt payments.

Assign money to savings goals and emergency funds before planning any fun spending. Allocate remaining money to wants—entertainment, dining out, and hobbies. Check that income minus all expenses equals zero. If you have leftover cash, assign it to debt payoff or extra savings.

How can implementing a zero-based budget impact personal financial management?

Zero-based budgeting makes you examine every expense each month. This awareness reveals spending patterns you might miss otherwise.

My savings rate jumped after I started using this method. Saving first, instead of waiting to see what’s left, changed everything.

Debt payoff sped up because I could redirect unused money right away. Traditional budgets often left this money unassigned and eventually spent.

I finally got control over irregular expenses like car repairs. Planning for these costs in advance made a huge difference.

Financial stress dropped as my money management became more intentional. Knowing where every dollar goes brings peace of mind.

What are some common misconceptions about zero-based budgeting?

Some people think zero-based budgeting means having zero dollars in your bank account. Actually, the “zero” just means giving every dollar a purpose.

Others believe this method is too restrictive. In reality, you can include money for fun if you plan for it.

Many assume zero-based budgets never change. I adjust mine regularly based on new needs and goals.

People often think this approach takes too much time. After initial setup, monthly maintenance only takes about 30 minutes.

Another myth is that zero-based budgeting only works for steady incomes. Variable earners can use it too by budgeting conservatively and adjusting as money comes in.

Can you provide specific examples of how zero-based budgeting differs from traditional budgeting methods?

Traditional budgeting often starts with last month’s numbers and tweaks them. Zero-based budgeting starts fresh each month with your income as the foundation.

In traditional budgets, you might automatically allocate $300 for groceries. With zero-based budgeting, you ask if $300 still makes sense this month.

Traditional methods leave unspent money sitting in your account. Zero-based budgeting assigns every leftover dollar to a specific goal.

Regular budgets track spending after it happens. Zero-based budgets plan every dollar before you spend it.

Traditional approaches might slowly increase entertainment spending over time. Zero-based budgeting makes you justify those expenses each month based on your priorities.

What tools or templates are available to simplify the process of zero-based budgeting?

Simple spreadsheets work great for beginners. Create columns for income, expenses, and remaining balance to keep things organized.

Apps like YNAB (You Need A Budget) are designed for zero-based budgeting. They help you assign every dollar a job automatically.

Free templates are available on many personal finance websites. These often include pre-made categories to speed up setup.

Pen and paper methods are just as effective for those who prefer writing things down. Simple worksheets can be powerful.

Some banks offer budgeting features in their apps. These can integrate spending tracking with zero-based budgeting principles.

What challenges might one face when first adopting zero-based budgeting and how can they be overcome?

The initial time investment can feel overwhelming. I like to start with just a few basic categories and add more detail over time.

Irregular income often makes zero-based budgeting look impossible. I budget for the lowest amount I expect to receive and treat any extra income as a bonus, assigning it new jobs when it arrives.

It’s easy to forget about annual or quarterly expenses. I break yearly costs into monthly amounts and save a little each month, so big bills never catch me off guard.

Family members sometimes resist a detailed budgeting process. I invite everyone to join in budget meetings and encourage each person to suggest priorities for discretionary spending.

Perfectionism can trip you up if you overspend in a category. I remind myself that budgets are flexible, and it’s okay to adjust the plan when life throws a curveball.