Ever feel like no matter how hard you work or how closely you follow financial advice, money still slips through your fingers? I’ve been there, and honestly, it’s frustrating. What if I told you the real culprit might be hiding in your own mind? Money blocks—those sneaky, deep-rooted beliefs and fears—can sabotage your financial success without you even noticing.

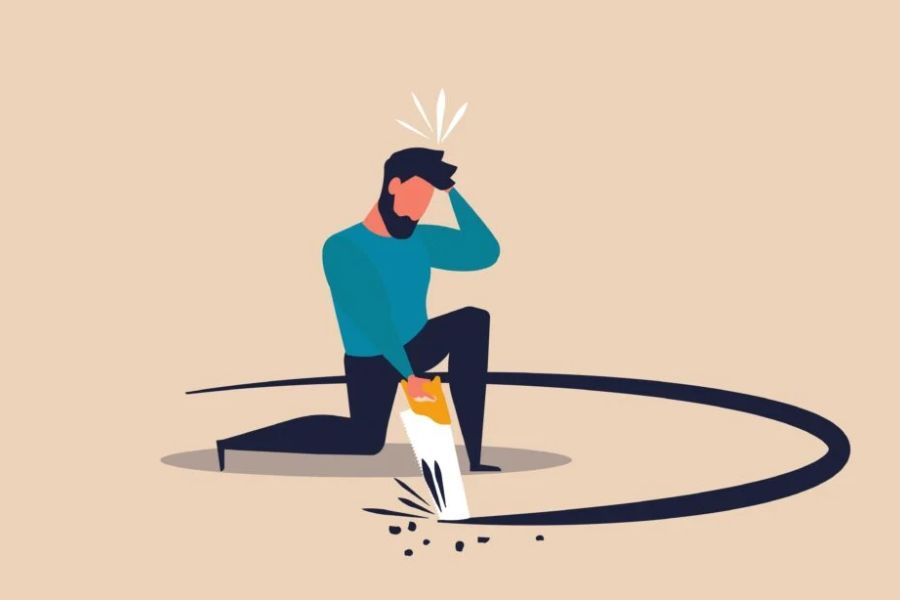

I’ve watched friends and clients fall into the same financial ruts over and over. They budget, they save, they hustle… and yet, something always trips them up. Most folks don’t realize that the majority of our money decisions—about 95%—happen subconsciously. These invisible mental barriers make us dodge opportunities, undervalue ourselves, or even push money away.

But here’s the thing: once you spot these blocks, you can actually do something about them. Let me walk you through the most common money blocks that might be holding you back, along with some practical steps to break free. I promise, when you clear these mental roadblocks, money starts to flow a little easier—and your financial life can finally turn around.

Key Takeaways

- Money blocks are subconscious beliefs that shape your financial decisions and keep you stuck in struggle cycles.

- The most common blocks? Feeling unworthy of wealth, thinking money is evil, or believing you’re just “bad with money.”

- To break free, you’ll need to get aware, challenge those old beliefs, and start building new, empowering habits.

Understanding Money Blocks and Their Impact

Money blocks act like invisible tripwires that mess with your financial progress. Most of the time, you don’t even realize they’re there. These beliefs get so deeply rooted that they create patterns—patterns that keep you stuck in financial struggle, no matter how much you know or earn.

What Are Money Blocks?

Let’s get real: money blocks are those subconscious beliefs and mental habits that keep you from financial success. They’re like invisible walls that stop money from flowing your way.

I think of money blocks as any belief that quietly holds you back from the wealth you want. They’re not just thoughts you notice; they’re buried deep, running the show behind the scenes. Most of us pick up these blocks as kids. We soak up messages about money without even realizing it.

Ever heard these growing up?

- “Money doesn’t grow on trees.”

- “Rich people are greedy.”

- “We can’t afford that.”

- “Money is the root of all evil.”

These phrases get stuck in your brain and become your personal money story. You carry them into adulthood, rarely stopping to question if they actually make sense.

Money blocks slip under your radar. Spotting them can be tough, and changing them? Well, that’s even tougher. You might swear you want more money, but your subconscious could be telling a whole different story.

How Money Blocks Show Up in Real Life

Money blocks sneak into your daily decisions in ways that are easy to miss. They shape your habits, often keeping you broke or stuck. I’ve noticed these blocks pop up as resistance—like when someone hesitates to ask for a raise or charge what they’re worth. Maybe you get anxious checking your bank account, or you dodge looking at bills altogether.

Some people work themselves to exhaustion and still never get ahead. Others seem to self-destruct right before they hit a big financial win. It’s not a character flaw—it’s those money blocks at work.

Here’s how they usually show up:

| Area | How It Shows Up |

|---|---|

| Work | Undercharging, skipping promotions |

| Spending | Impulse buys, guilt, hoarding cash |

| Relationships | Arguing about money, hiding purchases |

| Planning | Dodging budgets, skipping retirement savings |

Money blocks can even make your body react. Ever feel your stomach knot up when talking about money? Or your heart race before a big decision? A lot of people confuse these blocks with actual limitations. They think they just need more education or a better job. But honestly, it’s often just their mindset tripping them up.

Mindset and Your Money: Why It Matters

Your money mindset absolutely shapes your financial results. In my experience, shifting those inner beliefs has way more impact than changing jobs or getting a raise.

People with an abundance mindset spot opportunities everywhere. They believe money can flow easily, and there’s more than enough to go around. That belief nudges them to take actions that build wealth. On the flip side, folks with a scarcity mindset see nothing but roadblocks. They think money is hard to earn or keep, and their actions just reinforce that belief.

Your brain loves to prove itself right. If you think wealthy people are jerks, you’ll notice every story that supports it and ignore the rest. Research backs this up—mindset affects your financial choices more than your education or income. If you believe you deserve wealth, you’ll find ways to make it happen. If you don’t, you’ll probably sabotage yourself.

Here’s the good news: you can change your mindset. Your current money situation isn’t set in stone. When you start shifting those money blocks, you open the door to new financial patterns.

Common Money Blocks That Keep You Broke

Money blocks are like mental speed bumps that stop you from building wealth. They usually come from beliefs about your worth, negative ideas about money, fear-driven choices, and self-sabotaging habits.

Limiting Beliefs About Self-Worth and Wealth

One of the worst money blocks? Believing you don’t deserve financial success. This one runs deep and colors every money move you make. That sneaky voice saying, “I’m not good enough,” holds a lot of people back. When you don’t value yourself, you settle for lower pay and skip asking for raises.

Sometimes you convince yourself that successful people have some secret skill you lack. That belief makes you accept less than you deserve.

Self-doubt creeps in everywhere:

- Undercharging for your work

- Ignoring higher-paying job openings

- Skipping investment opportunities

- Accepting financial struggle as “just how it is”

Some folks think you’ve got to be born rich to get rich. That’s just not true—plenty of people have built wealth from scratch.

The “not enough” mindset also shows up as the belief that there’s only so much money to go around. You end up feeling threatened by other people’s success. These beliefs create a cycle. You don’t chase better opportunities because deep down, you don’t think you’re worthy.

Negative Views About Money and Wealthy People

A lot of us grew up hearing that money is bad or that rich people are greedy. These beliefs can seriously block your path to wealth.

Some of the classics:

- Money is the root of all evil

- Rich people are selfish

- Money makes you materialistic

- Poor people are more honest

If you hold onto these, your brain will fight against getting rich. You don’t want to become someone you secretly dislike.

Society loves to reinforce these ideas, too. Movies and books often paint wealthy people as villains. It starts early and sticks. You might even feel guilty for wanting more money. That guilt keeps you from taking steps to improve your finances. But here’s the truth: money’s just a tool. Good people with money can do a lot of good.

Money simply amplifies who you are. If you’re generous now, you’ll stay generous with more money.

Fear-Based Money Habits

Fear drives a lot of money decisions that keep people stuck. Usually, these fears come from bad past experiences or anxiety about what’s next. Fear of losing money makes some folks hoard cash instead of investing. They keep everything in low-interest accounts and miss out on growth.

Others swing the other way. Fear of not having enough leads to overspending on things they don’t need. A single bad money mistake can haunt you for years. One bad investment and you might swear off investing forever.

Some common fear-based habits:

- Avoiding financial planning

- Ignoring bank statements

- Refusing to learn about investing

- Staying stuck in “safe” but low-paying jobs

Fear of success trips people up, too. You might worry that money will change you or mess up your relationships. Some even fear the responsibility that comes with wealth. They imagine money means constant stress.

Self-Sabotage and Procrastination

Self-sabotage is when you work against your own financial goals, often without realizing it. It’s a sneaky money block that can wreck your progress. Procrastination is a big one here. You put off budgeting, investing, or paying off debt.

Maybe you start a budget but stop tracking after a few days. Or you read about investing but never actually do it.

Other self-sabotage patterns:

- Spending right before reaching a savings goal

- Quitting a job right before a promotion

- Letting good business ideas fade away

- Creating financial emergencies by not planning

Perfectionism can also lead to self-sabotage. You wait for the “perfect” time to start saving or investing. Sometimes, when things start going well, you unconsciously mess it up—because deep down, you don’t believe you deserve it.

Comfort zones are powerful. Even if your financial situation isn’t great, it can feel safer than trying something new.

Effective Strategies to Break Money Blocks

Breaking money blocks takes action. You need to target your beliefs, set clear goals, and build a new mindset. Here are some steps that have worked for me and others:

1. Spot and Shift Limiting Beliefs

I pay attention to my money thoughts as they pop up. Sometimes it’s, “I don’t deserve wealth,” or “Money changes people.”

Write down your money thoughts for a week. Notice what goes through your mind when you pay bills, check your balance, or hear about someone’s big win. Look for patterns. Do you feel guilty wanting money? Think rich people are bad? Those are classic limiting beliefs.

Challenge each one. Ask yourself: Is this true? Where did I pick this up? What evidence do I actually have? Swap out negative thoughts for positive ones. When I catch myself thinking, “I’m bad with money,” I switch it to, “I’m learning to manage money better every day.”

I like to use affirmations, too. I write them down and say them out loud, even if it feels silly. Over time, it really helps rewire my brain.

2. Set Clear, Actionable Financial Goals

I write down specific amounts and deadlines for my goals. “Save more” doesn’t cut it. “Save $5,000 by December 31st” gets results.

Make three types of goals:

- Short-term (1–6 months)

- Medium-term (6 months–2 years)

- Long-term (2+ years)

Break big goals into monthly steps. Want to save $12,000 this year? That’s $1,000 a month. I check my progress weekly. It keeps me honest and motivated.

Put your goals where you’ll see them—on your phone, bathroom mirror, wherever. The daily reminder helps keep you focused. Don’t forget to celebrate small wins. When I hit 25% of a savings goal, I treat myself to something small.

3. Build a Growth-Oriented Money Mindset

I make it a point to learn new money skills. Books, courses, podcasts—you name it. Practice abundance thinking. I look for ways to earn more, whether it’s side hustles, asking for a raise, or adding value at work.

I try to change how I talk about money. Instead of “I can’t afford it,” I ask, “How can I afford it?” It’s a small shift, but it sparks creative solutions. I surround myself with people who have healthy relationships with money. Online groups and mentors make a huge difference.

Take small financial risks to build confidence. Maybe invest $50 in stocks or sell something online. Experience beats theory every time. Above all, I remind myself that money is just a tool. It helps me care for my family, support causes I love, and build a life I’m proud of.

Building Sustainable Wealth After Breaking Money Blocks

Once you break those money blocks, you open up a world of wealth-building possibilities. I focus on creating multiple income streams, passive investments, and modern earning methods like freelancing or digital products. Long-term planning is key, but so is the courage to just get started.

Creating Multiple Streams of Income

Honestly, I learned the hard way—counting on just one paycheck feels risky. Once you start clearing those mental money blocks, it’s wild how many new ways to earn cash pop up. Start with what you already know. Maybe you’ve got skills you can turn into a side business or offer as a service.

Consulting, teaching, or even selling something you’re passionate about—these can all work. You don’t have to reinvent the wheel.

Here are proven income streams you might want to try:

- Part-time business or side hustle

- Rental property income

- Stock dividends and interest

- Online course sales

- Affiliate marketing commissions

I always say, start small. Pick two or three income streams and focus there. Trying to do everything at once? It’ll just burn you out.

Every new stream takes a while to get rolling. But once you’ve got a few going, you’re less stressed if one dries up. Keep tabs on each stream monthly. Jot down what each one brings in.

Tracking helps you see what’s working (and what’s not), so you know where to double down.

Investing and Growing Passive Income

Investing got way less scary for me after I ditched my money fears. Suddenly, I noticed opportunities instead of just worrying about losing cash.

If you’re not sure where to start, check out these basic investment options:

- Index funds for steady growth

- Dividend stocks for regular income

- Real estate investment trusts (REITs)

- High-yield savings accounts

- Bonds for stable returns

Even putting in $100 a month makes a difference if you stick with it. Consistency wins, not huge one-off bets.

Passive income? That’s money showing up whether you’re working or not. Dividends, rental income, interest—these are the heavy hitters. Set up automatic investing. It’s the lazy way to stay on track, and honestly, it works.

Compound interest is your best friend. Your money earns more money, and then that money earns even more.

Embracing New Paths: Freelancing and Digital Products

The internet totally changed the game for making money. Now, freelancing and digital products let you earn from anywhere—even your couch. Freelancing means you sell your skills directly to clients. Writing, design, coding, marketing—you name it.

Some folks make a full-time living this way. Not bad, right?

Popular freelancing platforms:

- Upwork

- Fiverr

- LinkedIn ProFinder

- Freelancer.com

Digital products are another goldmine. You create something once—like a course, ebook, template, or app—and sell it over and over. No need to stock up on inventory or ship anything. That’s a relief.

Figure out what you know that people want to learn. Build some content around it. Platforms like Udemy or your own website make selling easy.

I’ve watched people turn digital products into six-figure incomes. The trick? Solve real problems for real people. Test your idea with a simple version before you go all in. See if folks actually want it.

Achieving Long-Term Financial Freedom

Financial freedom means you’ve got enough coming in that you stop stressing about bills. Your investments and passive income cover what you need.

Figure out your comfortable monthly number. Multiply that by 300. That’s your investment target.

Steps to get there:

- Track every expense

- Save at least 20% of what you earn

- Invest steadily in growth assets

- Build multiple income streams

- Crush debt as much as you can

How long does it take? Depends on your numbers. Some get there in a decade, others need longer. Focus on boosting your income, but don’t slash every fun thing from your budget. Misery isn’t worth it. Every three months, check your progress. Tweak your plan if something’s off.

Financial freedom isn’t just about money—it’s about having choices. That’s the real win.

Frequently Asked Questions

Money blocks? They’re those sneaky mental hurdles that hold you back from financial success. Limiting beliefs, emotional triggers, even self-sabotage—they all play a role.

Once you spot these patterns, you can actually do something about them.

What are the common psychological barriers to financial success?

Fear of failure keeps a lot of people stuck. You might skip investing or never start that side hustle, even when it’s a good opportunity. Scarcity mindset whispers that there’s never enough to go around. If someone else wins, you lose—at least, that’s the lie.

Worthiness issues tell you wealth isn’t for you. Usually, these start way back in childhood. Perfectionism freezes you up. You keep waiting for the “right” investment or plan instead of just getting started.

Money shame brings guilt just for wanting more. Talking about money? That gets uncomfortable fast.

How can I identify and overcome self-sabotaging financial behaviors?

Track your spending for a month—no judgment, just data. Notice what you buy when you’re stressed or sad.

If you avoid looking at bank statements or bills, that’s a red flag. There’s usually a money fear lurking underneath.

Pay attention to your money self-talk. Saying “I’m terrible with money” or “I’ll never be rich” just reinforces bad habits.

Start with one positive habit. Maybe stash your loose change or read one finance article a week.

Challenge those negative thoughts. If you think “I can’t save,” list times you actually did.

What strategies can help break through negative spending habits?

Try a 24-hour pause before buying anything over $50. It’s amazing how often you’ll skip it after waiting.

Use cash for fun spending. Swiping a card doesn’t feel real, but handing over bills does.

Figure out your emotional spending triggers. Keep a spending journal and jot down your mood before each buy.

Swap shopping for free stuff when you’re stressed. Walk, call a friend, or dive into a hobby instead.

Set up automatic transfers to savings. When your money moves before you see it, you avoid temptation.

Can mindset shifts lead to improved money management skills?

Shifting from “I can’t afford it” to “How can I afford it?” opens up creative solutions. Suddenly, you’re brainstorming instead of shutting down.

See money as a tool, not the enemy. It lets you live your values and help others.

Thinking abundance instead of scarcity makes you less anxious. You start spotting opportunities all around.

Believing you deserve wealth pushes you to take action. You’ll negotiate harder and chase better deals.

What role does emotional intelligence play in breaking poor financial patterns?

Spotting your emotional triggers helps you avoid impulse buys. You get a chance to pause and choose, not just react.

Understanding your past lets you break old family money cycles. You can make new choices, not just repeat history.

Managing money anxiety with breathing or mindfulness keeps you focused. Better decisions follow when you’re calm.

Patience is huge. It helps you stick with saving and investing, even when it’s slow going. Emotional maturity keeps you on track when things get tough.

How do past experiences influence current financial decisions and how can one address them?

Let’s be real—most of us aren’t even aware of how much our childhood shapes our money habits. I remember my parents always saying, “money doesn’t grow on trees,” and honestly, that stuck with me. It’s easy to fall into a scarcity mindset without even realizing it.

Have you ever lost a job or dealt with a nasty financial surprise? Those moments can leave you feeling terrified of taking any risks. I’ve definitely hesitated before making investments, worried that the past might just repeat itself.

Family drama around money? Oh, that’s a classic. If your parents argued about bills, you might find yourself dodging money talks with your partner, just to avoid conflict.

So, what can you actually do about all this? Start by jotting down your earliest money memories. It sounds simple, but it’s weirdly powerful to see those old beliefs on paper.

Next, try swapping out those outdated thoughts. Daily affirmations help—things like, “I’m good with money,” or “I deserve financial success.” It might feel silly at first, but it works over time.

And if your financial past feels too heavy to tackle alone, reaching out to a financial therapist can make a world of difference. Sometimes, getting a little help is the bravest thing you can do for your financial future.