Let’s be real—your savings account probably isn’t doing much for you right now. Traditional banks barely give you 0.01% to 0.05% interest, which is honestly just a few pennies a year. But the best high-yield savings accounts in 2025? They can get you up to 5.00% APY. That’s not a typo—it’s 100 times more than what most folks get from their regular bank.

I’ve spent a ridiculous amount of time digging through all the options out there. The results? Some accounts actually put real money back in your pocket, not just numbers that look good on paper. Switching from a regular savings to a high-yield one could mean you pocket hundreds, maybe even thousands, extra every year.

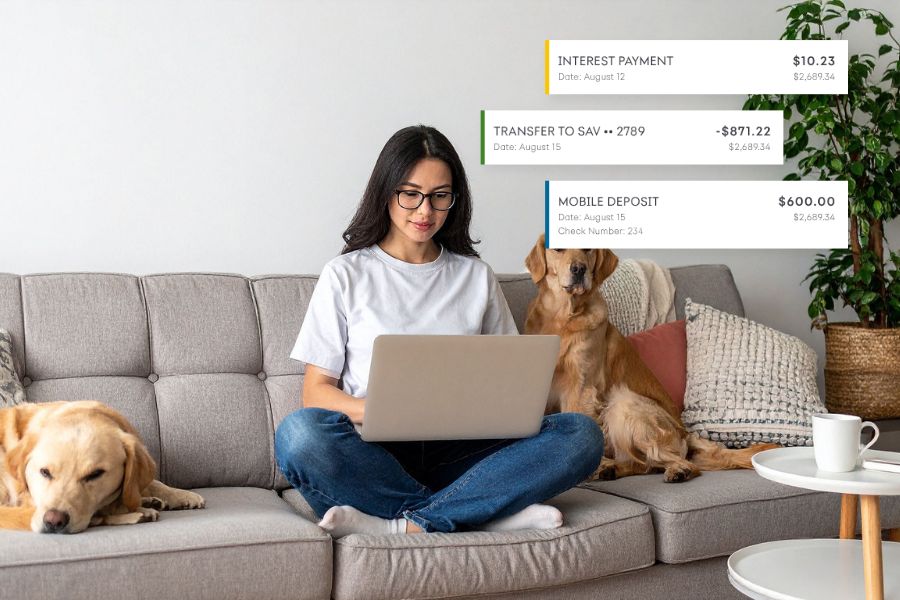

Banking has changed so much. Digital banks and online-only institutions are shaking things up, handing the savings straight to customers through higher rates. In this guide, I’ll show you which accounts are worth your attention, what to watch for, and how to make sure your money works as hard as you do—without sacrificing safety or easy access.

Key Takeaways

- High-yield savings accounts can get you up to 5.00% APY, while old-school banks stick to 0.01%–0.05%.

- The best accounts in 2025? Think online banks like Synchrony, American Express, and Capital One, with rates from 3.40% to 5.00%.

- Your money stays FDIC insured up to $250,000, and you actually earn something thanks to daily compounding interest.

High-Yield Savings Accounts Explained

High-yield savings accounts pay interest rates up to 10 times higher than regular savings accounts. Right now, the top ones are over 4% APY. Online banks usually lead the pack because they don’t waste money on fancy buildings.

What Makes a Savings Account ‘High-Yield’

A high-yield savings account (HYSA) simply pays way more interest than your average savings account. Regular accounts? The national average is just 0.52%.

Here’s what high-yield accounts give you:

- 4% to 5% APY (sometimes more)

- Compound interest that helps your savings snowball

- FDIC insurance up to $250,000 per account

The main thing to look at is the annual percentage yield (APY). That’s how much your money grows in a year, including compounding.

Let’s say I put $10,000 in a regular savings account at 0.52% APY. After a year, I’d only see about $52 in interest. But drop that same amount in a high-yield account at 4% APY? I’d get $400.

Most high-yield savings accounts skip the monthly fees. Some might ask for a minimum balance, but honestly, the best ones don’t even bother with that.

The Role of Online Banks

Online banks crank up their savings rates since they don’t have to pay for physical branches. They pass those savings right on to us.

Why online banks rock:

- Higher APY rates (think 3–5% instead of 0.1–0.5%)

- Lower or no monthly fees

- 24/7 account access via apps and websites

Banks like Ally, Live Oak, and Bread Savings always seem to be at the top of the rate charts. They’re just as safe as traditional banks, thanks to FDIC insurance.

The downside? No walking into a branch or depositing cash in person. Transfers to checking accounts can take a couple of days.

But if you’re chasing the best returns, online savings accounts leave traditional banks in the dust.

High-Yield vs. Traditional Savings Accounts

The real difference between high-yield and traditional savings accounts comes down to what you earn and how you get to your money.

Interest Rate Comparison:

| Account Type | Typical APY | Annual Earnings on $10,000 |

|---|---|---|

| Traditional Savings | 0.1% – 0.5% | $10 – $50 |

| High-Yield Savings | 4% – 5% | $400 – $500 |

Traditional banks make life easy if you want branch visits, instant transfers, or ATM access. High-yield accounts ask for a little more patience—transfers take longer, and you won’t find a branch nearby.

Still, I’d rather wait a day or two for a transfer and earn hundreds more each year. For emergency funds or short-term goals, high-yield accounts just make more sense. They help your savings keep up with inflation, and your money stays safe.

How High-Yield Savings Accounts Grow Your Money

High-yield savings accounts use compound interest and higher APY rates to help your money multiply. The Federal Reserve and inflation play a huge role in how much you can earn.

Understanding APY and Interest Rates

APY, or Annual Percentage Yield, tells you how much your money grows in a year.

APY isn’t just a simple interest rate. While the interest rate is the basic percentage, APY includes the magic of compounding. That’s what really matters for your bottom line.

Today’s high-yield accounts offer APYs between 3.40% and 5.00%. Traditional accounts barely hit 0.40%.

Here’s how that shakes out for your wallet:

| Account Type | APY | $10,000 After 1 Year |

|---|---|---|

| Traditional Savings | 0.40% | $10,040 |

| High-Yield Savings | 4.00% | $10,400 |

That’s $360 more just for picking a better account. Not bad, right?

Compound Interest in Action

Compound interest means you earn money on your original deposit and on the interest you’ve already earned. It’s like your money is working overtime.

Most high-yield accounts compound daily. That means every single day, the bank adds interest to your balance, and the next day, you earn interest on that new total.

Daily compounding beats monthly compounding, hands down. You start earning interest on your interest right away.

Let’s look at $5,000 growing at 4% APY with daily compounding:

- Month 1: $5,016.53

- Month 6: $5,100.84

- Year 1: $5,204.16

- Year 3: $5,635.18

You can see how the growth speeds up as the years go by. That’s why starting early really pays off.

How the Federal Reserve and Inflation Affect Rates

The Federal Reserve sets the federal funds rate, which basically controls what banks pay to borrow from each other. When the Fed raises rates, savings rates usually climb too.

Interest rates change with the economy. The Fed hikes rates to keep inflation in check and cuts them when things get tough.

Inflation quietly eats into your money’s buying power. If inflation is 3% and your savings only earn 1%, you’re actually losing ground.

These days, a lot of high-yield accounts pay more than the current inflation rate. That means you’re not just earning more dollars—you’re keeping your money’s value intact.

Banks update their APY rates all the time based on what the Fed does. Online banks usually offer the best rates since they don’t have the same overhead as traditional banks.

Top High-Yield Savings Accounts of 2025-26

Looking for the best high-yield savings accounts? Right now, some are offering up to 5.00% APY. Varo and SoFi are leading the charge. Some accounts skip the fees, while others make you set up direct deposits to get the top rate.

Best Overall High-Yield Savings Accounts

I’ve checked out dozens of accounts, and my top pick is Synchrony Bank High Yield Savings. You get 3.80% APY, no minimum balance, and daily compounding.

Marcus by Goldman Sachs is my runner-up at 3.65% APY. I like their customer service, and they don’t charge fees. You can move money around anytime, day or night.

American Express High Yield Savings lands in my top three with 3.50% APY. It’s great if you want a familiar name and a super smooth digital banking experience.

| Bank | APY | Min Balance | Monthly Fee |

|---|---|---|---|

| Synchrony Bank | 3.80% | $0 | $0 |

| Marcus by Goldman Sachs | 3.65% | $0 | $0 |

| American Express | 3.50% | $0 | $0 |

Highest APY Offers and Requirements

Varo Bank offers a wild 5.00% APY, but only on your first $5,000. You’ll need $1,000 in direct deposits each month and to keep positive balances in both checking and savings.

SoFi Bank goes up to 4.50% APY with their checking and savings combo. I love that they bump up FDIC insurance to $3 million. Direct deposit is required for the highest rate.

Banks with rates over 4.00% APY usually have hoops to jump through—direct deposits, balance caps, or other terms.

Top High-Yield Accounts for No Fees

Varo Savings Account stands out for avoiding fees. No monthly fees, no overdraft fees, and no minimum balance. Even their base rate of 2.50% APY beats most banks.

Capital One 360 Performance Savings gives you 3.40% APY with zero fees. If you want a bank with branches, this one’s worth a look. Interest compounds monthly, not daily, but the rate holds up.

Marcus by Goldman Sachs also keeps fees away. There are no charges for wire transfers between your own accounts. Plus, customer service is available 24/7 for free.

Business and Credit Union High-Yield Savings

Business savings accounts usually pay lower rates than personal ones. Most business accounts at big banks like Capital One and American Express offer 2.00% to 3.00% APY.

Credit unions can be surprisingly competitive. Lots of local credit unions match online bank rates, but you’ll need to meet their membership rules.

LendingClub and CIT Bank both serve personal and business customers with solid rates. Business accounts may ask for higher minimum balances than personal ones.

Comparing Account Features and Requirements

High-yield savings accounts come with a range of features and requirements. Some banks let you open an account with just a few bucks, while others want thousands. Watch out for monthly fees that could eat into your interest.

Minimum Deposit and Balance Requirements

Most of the best high-yield savings accounts don’t ask for a minimum deposit. You can open an account with American Express or Capital One with any amount. Marcus by Goldman Sachs doesn’t require a minimum balance either.

Some accounts do have conditions. Synchrony Bank doesn’t need a minimum deposit, but some banks might make you keep a certain balance to avoid fees.

The trick is earning the advertised rate. American Express pays the full 3.50% APY on any balance, but others make you jump through hoops.

Varo Savings asks for $1,000 in direct deposits each month to get the highest rate. If you don’t, your rate drops.

SoFi wants $5,000 in deposits or a direct deposit setup for their 3.80% APY. Otherwise, you’re stuck at 1.00% APY.

Monthly and Overdraft Fees

No monthly fees are the norm for the best high-yield accounts. American Express, Marcus, Capital One, and Synchrony all skip monthly maintenance charges.

That’s a big deal, since traditional banks often charge $5–$12 a month, which can wipe out your interest.

Overdraft fees rarely come up with savings accounts. Most banks, like American Express and Marcus, just decline transactions if you try to take out more than you have.

Synchrony makes it clear: no overdraft fees. Varo does the same—they just decline the transaction if your balance is too low.

The one fee to watch? Wire transfers. Synchrony charges $25 for outgoing domestic wires. Capital One asks $30 for domestic and $40 for international wire transfers.

ATM and Checking Account Access

Let’s talk about ATM card access—it’s all over the map with high-yield savings accounts. For some folks, this feature is a dealbreaker.

Synchrony Bank hands out ATM cards with their savings accounts. They hook you up with fee-free access on Plus and Accel networks, and they’ll even toss in up to $5 monthly in ATM fee reimbursements.

American Express and Marcus? Nope, no ATM access at all. You’ll have to stick with online or wire transfers to move your money.

Capital One skips ATM cards for their savings too. If you want ATM access, you’ll need to open a checking account on the side.

Checking accounts aren’t a given, either. Synchrony doesn’t offer them, and Marcus keeps things savings-only.

SoFi does something different by rolling checking and savings into one account. This means you get ATM access and earn interest on both your spending and saving balances.

Direct Deposit and Bonus Offers

Direct deposit requirements are popping up everywhere to unlock the best rates. Banks are definitely ramping up the competition here.

SoFi bumps you up to their full 3.80% APY only if you set up direct deposit. Without it, you’re stuck at just 1.00%.

Varo wants $1,000 in monthly direct deposits if you want to snag their 5.00% APY on your first $5,000. You start fresh every month.

Bonus offers can sweeten the deal, at least for a while. SoFi’s got a 0.70% APY boost for up to six months if you’re new and set up direct deposit.

Some banks, like American Express, Synchrony, and Marcus, don’t care how you fund your account. You’ll get their full rates without jumping through hoops.

Banks that dangle the highest rates usually ask for direct deposit. If you want more flexibility, you’ll probably have to settle for a moderate rate.

Safety, Flexibility, and Alternatives

High-yield savings accounts come with federal insurance, so your cash is protected. They’re also super flexible—perfect for easy access when life throws a curveball.

If you’re after different perks or higher rates, you might want to check out CDs or money market accounts.

FDIC and NCUA Insurance Explained

Your savings stay safe in high-yield accounts thanks to federal deposit insurance. Banks carry FDIC insurance, while credit unions use NCUA coverage.

Both shield up to $250,000 per depositor, per institution, per ownership category. So if your bank goes under, your money’s still protected.

I always make sure my bank’s website flashes that “Member FDIC” badge. That’s my peace of mind. Credit unions will show “NCUA” instead.

You can spread your money across different banks to cover more than $250,000. The limit resets at each institution.

Key protection details:

- Member banks and credit unions offer automatic coverage

- No paperwork needed—coverage kicks in right away

- Both your principal and interest are protected up to the limit

- Coverage varies for individual, joint, and retirement accounts

Some banks, like SoFi, stretch coverage beyond the standard. They use partner networks to insure deposits up to $3 million with special programs.

Liquidity and Access to Funds

High-yield savings accounts let you grab your money fast—no penalties. That’s why they’re a go-to for emergency funds and short-term savings.

Most banks allow instant online transfers. You can move cash to checking or external accounts, usually within a business day.

Common access methods:

- Online transfers with banking apps

- Wire transfers (sometimes with fees)

- Phone transfers via customer service

- ATM access (depends on the bank)

Some accounts put a cap on withdrawals—six per month is common. Others don’t bother with limits. I always peek at the withdrawal rules before signing up.

Synchrony gives you an ATM card for direct withdrawals. American Express and Marcus don’t, so you’ll need to transfer funds first.

Liquidity perks:

- No penalties for early withdrawals

- Money’s there when markets get rocky

- Easy to add or pull money

- Great for surprise expenses

Alternatives: CDs and Money Market Accounts

Sometimes a high-yield savings account isn’t the only answer. CDs and money market accounts each have their own sweet spots.

Certificates of Deposit (CDs):

CDs lock your money for anywhere from three months to five years. You get a guaranteed rate, usually higher than a savings account.

But the catch? Your money is stuck. Pull it out early, and you’ll pay in lost interest.

I use CDs for goals with a clear deadline. If I know I won’t need the money for a while, it’s a solid move.

Money Market Accounts:

Money market accounts blend savings and checking features. They usually ask for a higher minimum deposit but let you write checks.

These accounts often pay solid rates and give you more ways to access your cash. Some even come with debit cards and ATM access.

Quick comparison:

- High-yield savings: Top-notch liquidity, good rates

- CDs: Best guaranteed returns, but less access

- Money market: Good rates with more transaction options

Pick what matches your need for access versus your hunger for higher returns.

Maximizing the Benefits of High-Yield Savings

To really get the most out of your high-yield savings, focus on building a strong emergency fund, use these accounts for specific goals, and look for features like high rates and zero monthly fees.

Building Your Emergency Fund

Start with your emergency fund—seriously, it’s the first step. Aim for 3-6 months of living expenses and keep it separate from other savings.

High-yield accounts work beautifully for emergencies because you can access your money quickly. Plus, your interest compounds daily in most accounts, so your fund grows quietly in the background.

Set up automatic transfers from checking to savings. Even $50 a month adds up faster than you’d think, especially with a good rate.

Key amounts to save:

- Bare minimum: 3 months of expenses

- Ideal: 6 months

- Starting point: $1,000

Online banking makes it easy to pull funds in 1-2 business days if life throws you a curveball.

Setting and Reaching Your Financial Goals

High-yield savings accounts aren’t just for emergencies. They’re great for short-term goals—think vacations, home down payments, or even a new car.

Best goals for high-yield savings:

- Vacation funds (6-24 months out)

- Home down payment

- Car fund

- Wedding expenses

- Holiday gifts

Open separate savings accounts for each goal if you can. Lots of banks let you label them for motivation.

Match your timeline to your account. If your goal is two or three years away, high-yield savings works well. For longer-term dreams, you might want to explore other investments.

Track progress each month and adjust your transfers as needed. For example, if I need $6,000 for a trip in a year, I’ll set up $500 monthly transfers.

Tips for Choosing the Right Account

When I’m picking a high-yield savings account, I focus on three things: interest rate, fees, and access.

Interest rates are king for growing your money. I look for at least 3.5% APY—way better than most brick-and-mortar banks.

Fees can eat into your savings fast. I skip any account with monthly charges or minimum balance rules. The best accounts keep fees at zero.

Access features depend on your style:

- ATM access for emergencies

- Online banking for quick transfers

- Mobile apps for tracking and management

- Wire transfer capability

Think about whether you need a business savings account or just a personal one. Online banks usually offer better rates, but you’ll miss out on in-person help.

Don’t forget customer service. I always check reviews before opening an account—good support is a lifesaver when you need it.

Frequently Asked Questions

High-yield savings accounts spark a lot of questions, especially about rates, earnings, and which banks are best. People want to know where to get the highest return and how online banks stack up.

What Are the Top High-Yield Savings Accounts for Maximizing Returns?

Look for accounts paying above 3.5% APY. Synchrony Bank leads with 3.80% APY and even includes ATM access, which is rare for high-yield accounts.

American Express offers 3.50% APY with no minimums. Their digital platform is solid, but you won’t get ATM access.

Marcus by Goldman Sachs pays 3.65% APY and gets high marks for customer service. They also skip wire transfer fees, which is a nice bonus for bigger moves.

Varo Savings can go up to 5.00% APY on your first $5,000 if you meet their direct deposit requirements and keep a checking account.

How Can You Calculate Earnings from a High-Yield Savings Account?

I use the classic compound interest formula: A = P(1 + r/n)^(nt). A is your final amount, P is your starting balance, r is the annual rate, n is how often it compounds, and t is the number of years.

Let’s say you have $10,000 at 3.80% APY, compounding daily. After a year, you’ll make about $380 in interest. Monthly compounding earns a little less.

Most banks have calculators online, so you don’t have to do the math by hand. I always double-check the compounding frequency—daily is better than monthly.

What Benefits Do Online Banks Offer for High-Yield Savings Accounts?

Online banks usually pay rates 10x higher than traditional banks. Since they don’t have physical branches, they can pass the savings to you.

You get 24/7 support by phone or chat. Their apps often include tools for automatic saving and spending insights.

Most online banks skip the annoying fees—no monthly maintenance, no overdraft, and no minimum balance penalties.

The downside? No branches, so you can’t just walk in or deposit cash easily.

How Does Inflation Affect Your Money in a High-Yield Savings Account?

Inflation chips away at your money’s buying power, even in a high-yield account. If inflation’s 3% and your APY is 3.80%, you’re really only gaining 0.80%.

I keep an eye on inflation versus my APY. If inflation outpaces my interest rate, my savings lose value, even if the number goes up.

High-yield savings accounts do a better job fighting inflation than regular savings (which might pay just 0.05%). Still, for long-term growth, I mix in investments that can outpace inflation over time.

What Are the Key Factors to Consider When Choosing a High-Yield Savings Account?

Interest rate matters most, but I also watch how often banks change their rates. Some adjust them all the time, depending on what the Fed does.

I check for all possible fees—monthly, wire, ATM. Even small charges can wipe out your interest on a small balance.

Minimum balances can be a hurdle. Some accounts want $1,000 or more for the best rate; others have no minimums at all.

FDIC insurance protects up to $250,000 per depositor, per bank. I always confirm this before trusting any bank with my savings.

How Often Do Interest Rates Change on High-Yield Savings Accounts?

Interest rates on high-yield savings accounts shift a lot, mainly because of Federal Reserve decisions and whatever’s happening in the market. I’ve noticed some banks tweak their rates every month—sometimes even every week.

Online banks? They usually move the fastest. They jump on Fed rate changes quickly, trying hard to keep their offers attractive.

When the Fed bumps up rates, high-yield accounts usually follow suit. Sometimes you’ll spot a higher APY just days after a Fed announcement.

But rate changes aren’t always good news. Sometimes they drop, and that stings if you’re chasing the best returns.

I like to check my account’s rate at least once a month. If I see my bank falling behind the competition, I’ll think about switching to snag better earnings.