Turning $50 into $500 in just 30 days might sound far-fetched, but I’ve seen it happen—and done it myself. Legal money flipping is all about using smart strategies to multiply a small investment. Money flipping means investing a little cash to earn a bigger return. You can do this by buying and reselling items, investing in assets, or starting micro-businesses.

You don’t need one perfect method. The real magic happens when you combine several proven approaches—like retail arbitrage, domain flipping, micro-investing, and offering services you’re already good at. Let’s dive into the exact legal methods that real people use every day to grow their money. These aren’t get-rich-quick schemes, but practical business models that require effort and smart decisions.

Key Takeaways

- Money flipping uses legitimate business strategies to turn small investments into bigger returns.

- Combining several approaches works better than relying on just one.

- Legal money flipping takes research, effort, and planning, but it’s possible to turn $50 into $500 in 30 days.

Fundamental Principles: What It Really Means to Flip Money

Money flipping means using your money to generate returns by buying, improving, or reselling assets or services. Legal money flipping follows regulations and builds sustainable income streams.

Definition and Core Concepts

Flipping money is about turning a small amount of cash into a larger sum through smart investments or business activities. I like to think of it as putting your money to work, instead of letting it sit idle.

You spend money to make money. This could mean buying items to resell, investing in assets that grow in value, or starting small businesses that earn profits.

Key characteristics of money flipping:

• Initial investment – You need some starting capital.

• Time commitment – Results can take days or weeks.

• Active participation – You make decisions and take action.

• Profit potential – Returns can beat your initial investment.

Money flipping isn’t gambling. It’s about making calculated decisions using research and market knowledge.

The goal is to create positive cash flow. You want to consistently earn more than you spend on each flip.

Why Legitimacy Matters in Flipping

Sticking to legitimate money flipping keeps you safe from legal trouble and financial disaster. I’ve watched too many people get burned by scams that promise easy money. Legal methods follow business rules and create real value. You work with actual products, services, or investments that people want.

Benefits of staying legitimate:

• No risk of criminal charges

• Sustainable income

• Protection under consumer laws

• Potential to grow into a real business

Illegal schemes collapse fast. They need new victims to pay off earlier ones, and when that stops, everyone loses. I always research every money flipping opportunity. If it sounds too good to be true, it probably is. Legitimate methods also teach valuable skills—like understanding markets and customer service—that help in all areas of life.

Key Criteria for Legal Money Flipping

Legal money flipping must meet certain standards. I use these criteria to check every opportunity.

The method should involve real products or services with actual value. You’re not just shuffling money—you’re creating or adding value.

Essential legal criteria:

| Criterion | Legal Example | Illegal Example |

|---|---|---|

| Value Creation | Buying items to resell | Pyramid schemes |

| Market Based | Stock investments | Ponzi schemes |

| Transparent | Clear business model | Hidden fees |

| Regulated | Licensed platforms | Unregistered investments |

The opportunity should have clear documentation and terms. You need to know exactly how the money is made. Timeframes should be realistic. Most legal flipping takes weeks, not hours. Risk should match the potential reward. Higher profits mean more risk, but it should be clear and manageable.

I always check that any platforms or services are properly licensed and regulated. This keeps my money safer.

Best Legal Ways to Flip $50 Into $500 Fast

I’ve tested many ways to grow small amounts of money fast. The best results come from mixing buying and selling, online businesses, investment apps, and market research platforms.

1. Retail Arbitrage and Reselling Physical Goods

Retail arbitrage is my favorite way to quickly multiply $50. It’s simple: buy items cheap and sell them for more. Garage sales and flea markets are treasure troves. I hunt for books, clothes, electronics, and furniture priced at $1–$5.

Before buying, I check prices on Craigslist, eBay, and Facebook Marketplace. This helps me spot great deals. Flip furniture by finding solid pieces that need a little work. A $10 nightstand can sell for $75 after a quick makeover.

Flip books by scanning ISBN numbers with apps like Amazon Seller. Textbooks and rare editions can sell for ten times what you pay. Flip clothes by shopping for name brands or vintage finds. A $2 pair of jeans can fetch $30 online.

Start local and reinvest your profits. That’s how $50 can become $150 in a week, then $500 in three weeks.

2. Profitable Online Side Hustles

Online side hustles let you earn without buying inventory. Delivery jobs like DoorDash pay $15–$25 per hour during busy times. I sign up for DoorDash and work dinner rushes on weekends. Twenty hours at $20/hour brings in $400. Add your original $50, and you’re almost there.

Make money online using your phone in between deliveries. Try dog walking with Rover, renting parking spaces on Neighbor.com, or offering services on TaskRabbit.

Service-based gigs pay fast. You don’t have to wait for items to sell.

3. Micro-Investing and Automatic Savings Apps

Investment apps help your money grow while you work on other hustles. Acorns rounds up purchases and invests the spare change. I deposit $50 into Acorns and connect my debit card. Every purchase rounds up, and the difference goes to investments.

M1 Finance lets me buy fractional shares of stocks and ETFs. I set up weekly deposits from my side hustle earnings. Autopilot savings features make it easy to stash away money without thinking about it.

These apps won’t turn $50 into $500 alone in a month, but they help maximize every dollar you earn from other methods.

4. Leveraging Market Research and Survey Sites

Survey sites are a steady way to earn during downtime. I use Swagbucks, InboxDollars, and Survey Junkie to make $5–$15 a day. I fill out surveys during TV breaks or while waiting in lines. Swagbucks also pays for watching videos, shopping online, and searching the web.

Survey Junkie pays more per survey but takes more time. Rakuten gives cash back for online shopping. Many platforms offer sign-up bonuses of $5–$25. I grab these bonuses across multiple sites to boost my starting capital.

Using several platforms daily, you can earn $10–$15 a day from surveys. That’s $300–$450 in a month.

Online Asset Flipping Strategies: Domains, Websites, and Beyond

Flipping digital assets is another smart way to grow your money. Domains, websites, and digital products can offer quick profits if you know where to look.

5. Domain Flipping Tactics

Finding profitable domains starts with expired domain lists and auctions. I use GoDaddy Auctions and NameCheap to spot good deals. Short domains with common words sell fastest. Names with keywords like “tech,” “shop,” or city names move quickly.

Premium domains cost more but bring bigger profits. A $10 domain can sell for $100–$500 if it’s in demand. I avoid domains with spammy or adult content histories. Clean domains attract more buyers.

Research pricing on Flippa before listing. Price your domains just below market value for fast sales. List your domains on several platforms. I use Flippa, Sedo, and reach out directly to businesses that might want the name.

6. Website and App Marketplace Opportunities

Website flipping means buying existing sites, improving them, and selling for a profit. Empire Flippers and Flippa are my go-to marketplaces. I look for sites earning $100–$300 per month that sell for 20–30 times their monthly profit.

Quick fixes—like repairing broken links, speeding up pages, or adding content—can double a site’s value. Focus on ecommerce and content sites with affiliate income. These are easier to improve and sell.

Check where the site’s traffic comes from. Sites with organic Google traffic are more stable than those relying on paid ads.

7. Digital Products and Online Storefronts

Digital product flipping is all about buying and reselling online courses, software licenses, or templates. There’s no shipping, and profit margins are high.

I buy online stores on Shopify Exchange. Stores with good products but poor marketing are easy to improve. Software flipping works with apps that have users but need better marketing. Buy from developers ready to move on.

Social media accounts with big followings can sell for $500–$2,000. Accounts in profitable niches are especially valuable. Bundle small digital assets to increase value. Five $10 templates can become a $75–$100 package.

Dropshipping and affiliate sites can be improved and flipped within 30 days. Fix obvious problems like slow load times or weak product descriptions.

Boosting Profits with Investing, Real Estate, and Art Shares

Smart investing can turn $50 into $500 by using platforms for real estate, art, and fractional ownership.

8. Real Estate Flipping and Fractional Investments

Real estate investing offers great potential, even with small amounts. Fundrise lets you start with just $10 in crowd-funded real estate. Fractional investing means you can join house flipping projects without buying an entire property.

I focus on rental properties through REITs, flipping funds that pool investor money, and diversifying across several projects. Flipping houses takes time—often 6–24 months. The money stays invested during renovations, but annual returns can reach 15–25%.

Mortgage and holding costs can eat into profits if you buy properties directly. That’s why I prefer fractional investing for small amounts.

Investing in Art and Alternative Assets

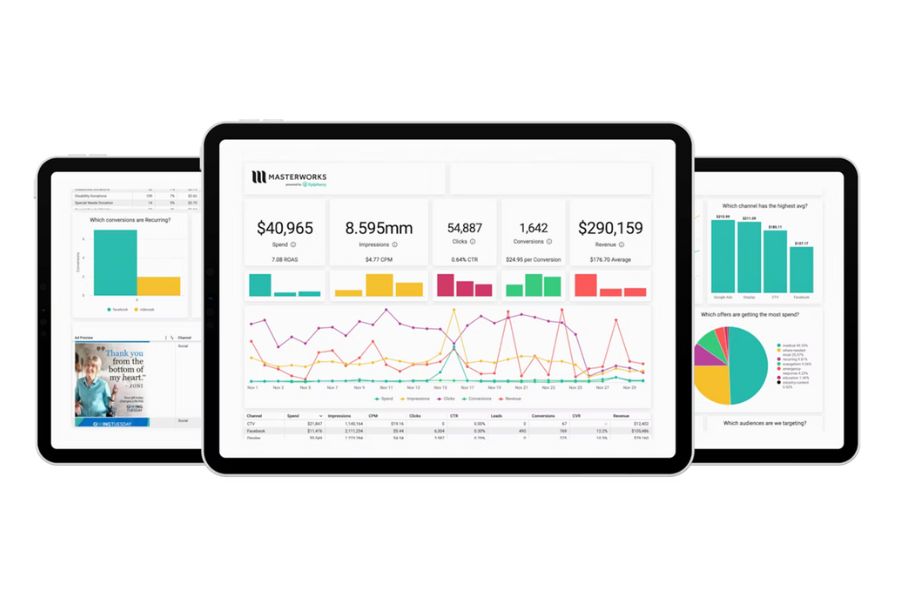

I love owning shares of expensive paintings through platforms like Masterworks. With just $20, I can start investing in art. Flipping art shares isn’t the same as flipping stocks. Art usually grows in value slowly over 3-10 years. I’ve personally seen annual returns of 8-12% on blue-chip artwork. While Bitcoin can offer faster gains, it also comes with higher risk.

I like to allocate 10-20% of my $50 to crypto for quick profit opportunities. Here’s the simple strategy I follow:

- 60% goes into established art pieces

- 30% into emerging artists

- 10% into high-risk crypto

I sell art shares when they gain 20-30% in value, which usually takes 2-5 years. This isn’t a quick flip, but the returns can be rewarding.

Maximizing Returns with Tech-Driven Investment Platforms

Platforms like Robinhood and Webull make commission-free trading possible. I can flip stocks with my full $50 without worrying about fees. Rocket Money (formerly Truebill) helps me track all my investments in one place. This budgeting tool highlights where my money grows the fastest.

Day trading demands constant attention and comes with high risk. Instead, I focus on:

- Dividend stocks that pay 3-5% quarterly

- Growth stocks in tech companies

- ETFs to spread risk across multiple assets

Most platforms now offer fractional shares. I can own a piece of Tesla or Apple with just $1.

A 30-day timeframe limits options, so I only flip stocks with high volatility if I’m prepared to lose that money. Never risk more than you can afford to lose.

Frequently Asked Questions

Here are the top questions I hear from people trying to turn $50 into $500. These answers cover real-life strategies from reselling products to smart investing.

What are the best investment strategies for a small initial investment like $50?

Start with micro-investing apps like Acorns or Robinhood. They let you invest in fractional shares with no minimum balance. Real estate crowdfunding platforms like Fundrise accept investments as low as $10. This means you can invest in income-generating properties without buying a whole share.

Peer-to-peer lending platforms like Kiva can generate 5-7% annual returns. You can split your $50 across several loans to reduce risk. High-yield savings accounts or CDs offer guaranteed annual returns of 4-5%. They protect your initial $50 while growing it slowly.

How can an individual effectively utilize day trading to grow $50 into a larger sum?

Day trading with only $50 isn’t ideal because most brokers require $25,000 for pattern day trading. Fees can quickly eat up any profits. If you still want to try, use commission-free platforms like Webull or TD Ameritrade. Focus on penny stocks or crypto, where small price changes can mean bigger percentage gains.

Always practice with paper trading for at least 30 days before risking real money. Set strict stop-losses at 5% to protect your capital. Day trading can wipe out your $50 in minutes without solid risk management.

Are there any reliable techniques to consistently make $50 a day through trading?

Turning $50 into $50 daily means a 100% daily return, which isn’t realistic or safe. Even professional traders aim for just 1-2% daily gains. Swing trading over 3-7 days offers better profit potential. Stick to established stocks with regular price swings between $20-$100.

Options trading can amplify your gains but also your losses. Start with covered calls or cash-secured puts if you already own the stock. Cryptocurrency trading is extremely risky. Only use money you can afford to lose.

What long-term investment options should one consider to transform $50 into a substantial amount over time?

Index funds like VTSAX or VOO have historically returned 7-10% annually. With patience, your $50 could grow to $500 in about 25-30 years. Adding $20-50 each month through dollar-cost averaging speeds up growth. Consistency matters more than market timing.

Roth IRA accounts let your investments grow tax-free. You can start with $50 and add more as you go. Growth stocks in tech or renewable energy can offer higher returns. Companies like Tesla and Apple have built real wealth for long-term investors.

Can you suggest some financial growth tactics for modest investments applicable for beginners?

Try the 50/30/20 rule: invest 50% in index funds, 30% in individual stocks, and 20% in alternatives like REITs. Reinvest all dividends to boost your returns automatically. Most brokers offer free dividend reinvestment programs (DRIPs).

Investing in your education pays off the most. Spend $10-20 on courses or books to make smarter financial decisions. Start a side hustle with your remaining cash. Use it to buy supplies for dog walking, lawn care, or online reselling and create extra income streams.

What are some practical steps to incrementally turn $50 into $500 within a month?

Flip Thrift Store Clothing

I love hunting for hidden gems at thrift stores. Once, I picked up a designer jacket for $5 and sold it on Poshmark for $75. Thrift shopping can be a treasure hunt, and flipping these finds often brings the fastest returns.

Resell Clearance Items from Retail Stores

I always check the clearance sections at Target or Walmart. Sometimes, I spot items priced way below what they sell for online. By grabbing these deals, you can resell them for a profit on platforms like eBay or Facebook Marketplace.

Start a Local Service Business

Offering services like yard work, house cleaning, or pet sitting is a fantastic way to multiply your money. With just $50, you can buy basic supplies and print flyers to spread the word in your neighborhood.

Flip Items on Facebook Marketplace

I’ve found great success flipping electronics, furniture, or sporting goods. The key is to spot underpriced items and resell them quickly to meet local demand.

Offer Freelance Services

If you have skills in writing, graphic design, or social media management, you can get started with almost no overhead. Use your $50 to set up a simple website or invest in marketing materials.

Turning $50 into $500 takes hustle, creativity, and a willingness to try new things. Choose the method that excites you the most and take action today!