When my monthly expenses started creeping up, I realized it was time for a change. Like many people, I lost track of where my money went each month. I managed to cut $800 from my monthly expenses by tackling my biggest spending categories. I focused on making small, daily changes that didn’t feel like sacrifices.

The process surprised me. Instead of feeling restricted, I felt empowered and happier with my spending choices.

Key Takeaways

- Start with your largest expenses for the biggest savings.

- Build simple daily habits to avoid overspending without feeling deprived.

- Make cuts that align with your values so you stay satisfied while saving money.

How I Identified and Tackled My Biggest Expenses

Finding out where my money went was the first step. I used easy tracking tools and a straightforward budget to spot my largest spending areas.

I focused on housing and transportation costs for the biggest impact.

1. Track Your Spending with Apps and Statements

I downloaded Mint to connect all my accounts in one place. The app sorted my spending into categories like food, entertainment, and bills. For three months, I printed my bank statements and highlighted every purchase. Green meant needs, yellow for wants, and red for impulse buys.

YNAB (You Need A Budget) became my favorite tool. It showed me where every dollar went before I spent it. I also created a basic budget template in Google Sheets. It tracked planned spending, actual spending, and the difference.

Seeing my spending habits in black and white was eye-opening. I spent $200 a month on takeout and $80 on small gas station purchases.

2. Use Zero-Based Budgeting for Clarity

Zero-based budgeting helped me assign every dollar a job before the month started. I allocated money to rent, groceries, savings, and fun until I reached zero. This method made me question every expense. Did I need three streaming services? Was a $50 gym membership worth it if I went twice a month?

I started each month by listing my income, then subtracting each planned expense until nothing remained. I paid myself first by putting $200 into my emergency fund. This kept me from spending what I needed to save.

The process took 30 minutes a month and saved me hundreds. I always knew exactly what I had for groceries, gas, and entertainment. When surprises popped up, I moved money from other categories. This forced me to think twice about impulse purchases.

3. Save Big on Housing and Transportation

Housing ate up 40% of my income, so I tackled it first. I negotiated my rent down by $100 by signing a longer lease and handling small repairs myself. I found a roommate who paid $300 a month. This nearly cut my housing costs in half.

I shopped around for car insurance every six months. Switching companies saved me $40 a month with the same coverage. Carpooling to work three days a week with coworkers cut my gas costs by $60 a month.

I sold my car and bought a reliable used one with no monthly payment. That eliminated $280 in car payments and lowered my insurance costs. For weekends, I used public transportation. A monthly bus pass cost $45 instead of $120 in gas and parking.

Simple Strategies to Slash Recurring Bills

Big wins came from reducing monthly bills I already paid. These changes took little effort but delivered major savings.

4. Cancel Unused Subscriptions and Memberships

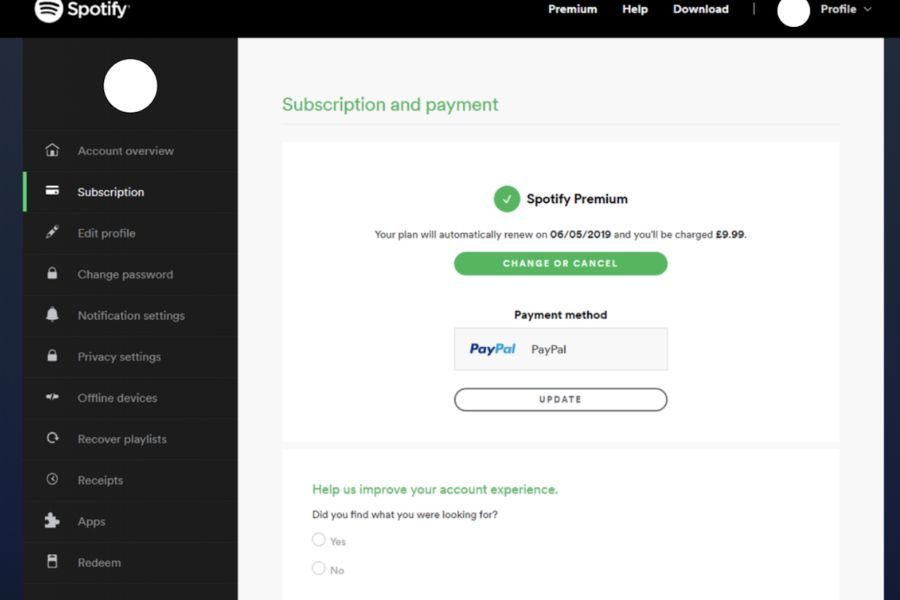

I reviewed my bank statements from the past three months. I found $127 in monthly charges I barely noticed.

Some surprises:

- $39 gym membership I used twice in six months

- $12 photo editing app I downloaded for one project

- $25 premium music service (when I already had another)

- $19 cloud storage I never filled up

I canceled unused subscriptions through my phone’s app store. For the gym, I visited in person and canceled on the spot.

My system:

- Set phone reminders for free trial end dates

- Check bank statements monthly for recurring charges

- Use apps like Truebill to spot forgotten subscriptions

This step alone saved me $127 per month.

5. Negotiate and Reduce Bills

I called five companies to ask for lower rates. Four of them reduced my bills within ten minutes. My phone company cut my plan by $23 a month when I mentioned switching. My internet provider offered a $15 discount for bundling with cable.

My go-to script:

“I’ve been a loyal customer for [X years] but need to lower my monthly expenses. What discounts or promotions can you offer to keep my business?”

I saved $67 a month by:

- Lowering my phone bill by $23

- Saving $15 on internet

- Cutting car insurance by $19

- Reducing credit card interest from 18% to 12%

Persistence paid off. I asked for the retention department when regular customer service couldn’t help.

6. Lower Insurance Premiums and Interest Rates

I reviewed my insurance coverage and found easy ways to save money. My car insurance dropped $34 a month when I increased my deductible, removed rental car coverage, and claimed a good driver discount.

For credit cards, I called and asked for lower interest rates. One card reduced my rate from 22% to 16%. Another required a balance transfer to a 0% promo rate.

My checklist:

- Compare quotes from three companies each year

- Ask about discounts for good driving, bundling, or autopay

- Review coverage to avoid paying for extras I didn’t need

These changes saved me $51 a month on insurance.

7. Automate Savings to a High-Yield Account

I moved my emergency fund to a high-yield savings account earning 4.5%. This boosted my interest to $18 a month on a $5,000 fund. I automated $200 transfers from checking to savings every payday.

My setup:

- Direct deposit splits between checking (80%) and savings (20%)

- Automatic transfer of $200 every payday

- Round-up feature saves spare change from purchases

Automation removed the temptation to skip saving. My money grew with zero effort.

I found online banks offering rates much higher than traditional banks. Setup took just 15 minutes.

Daily Habits That Made Saving Easy

Small daily choices made the biggest difference. I learned to pause before buying, improved my cooking routine, and found ways to cut utility bills.

8. Stop Impulse Purchases with the 48-Hour Rule

I used to buy things as soon as I wanted them. This drained my wallet. The 48-hour rule changed everything. When I wanted something non-essential, I wrote it down and waited two days.

Most of the time, I forgot about it. If I still wanted it, I asked:

- Do I really need this?

- Where will I use it?

- What will I stop buying to afford it?

This habit stopped about 70% of my impulse buys. I saved around $200 a month just by waiting. For online shopping, I added items to my cart but waited two days before checking out. Usually, I deleted everything.

9. Cook at Home, Batch Cook, and Buy in Bulk

Eating out cost me $400 a month. I had to change fast. I started cooking at home six days a week. Sundays became batch cooking days.

My favorite batch meals:

- Chili (8 servings for $12)

- Chicken and rice (6 servings for $10)

- Pasta with meat sauce (10 servings for $15)

I bought staples like rice and pasta in bulk. A 20-pound bag of rice cost $8 and lasted three months.

I kept easy backup meals like canned soup and eggs for nights I didn’t want to cook.

10. Cut Utility Costs by Unplugging and Upgrading

Small changes dropped my utility bills by $80 a month. I unplugged devices when not in use—TV, coffee maker, chargers. This “phantom load” cost me $25 a month.

Before bed, I unplugged three things: coffee maker, TV, and chargers. I switched to LED bulbs. My electric bill dropped $15 a month.

I adjusted my thermostat by three degrees—down in winter, up in summer. I wore sweaters inside during cold months. This saved $40 a month on heating and cooling.

11. Shop Secondhand and Use Loyalty Programs

I stopped buying new unless I had to. Thrift stores and online marketplaces became my go-to. Facebook Marketplace was great for furniture and electronics. I found a coffee table for $30 instead of $150 new.

I bought clothes from thrift and consignment shops. I signed up for loyalty programs at every store I used. My grocery store sent personalized coupons that saved $20–$30 a month.

Cashback apps like Ibotta and Rakuten added $15–$25 a month to my savings. I used an app to organize all my loyalty cards, so I never missed a reward.

Making It Stick Without Feeling Deprived

The real challenge is making these changes last. I found success by changing how I think about needs versus wants and celebrating wins that don’t cost money.

12. Redefine Needs vs. Wants

I got honest about what I really needed. This mindset shift helped me cut expenses by $400 a month. My old self called everything “necessary.” Premium cable, daily coffee runs, and name-brand groceries all felt essential.

Now I ask: “Will this matter in six months?” Most things don’t pass the test. That $6 coffee? Gone in an hour. Expensive face wash? The $3 drugstore version works just as well.

Here’s how I changed my thinking:

| Category | What I Thought I Needed | What I Actually Needed |

|---|---|---|

| Coffee | $6 daily coffee shop drinks | $1 homemade coffee |

| Entertainment | Multiple streaming services | One service at a time |

| Groceries | Name brands only | Store brands |

I stopped calling wants “needs.” This made it easier to save money without feeling like I was missing out.

Celebrating Progress and Finding Free Joy

Finding free ways to celebrate wins keeps me motivated. Every month I hit my savings goal, I reward myself without spending a dime. I made a list of activities that bring me joy. Nature walks, library visits, and cooking new recipes with ingredients I already have became my favorite ways to celebrate.

My favorite free rewards include:

- Taking a long bath with candles I already own

- Calling a friend I haven’t talked to in months

Trying a new hiking trail always feels like an adventure. I also enjoy having a movie marathon with films from the library.

To track my progress, I use a visual chart. Each month I save $800, I color in a square, and watching those colors grow feels incredibly satisfying. Replacing expensive habits with free ones changed my mindset. Instead of shopping when stressed, I go for walks.

Rather than dining out, I invite friends over for potluck meals. These simple swaps make saving money feel rewarding and sustainable.

Frequently Asked Questions

People often ask me how I manage to save $800 each month. Most questions focus on cutting utility bills, reducing grocery costs, lowering transportation expenses, managing subscriptions, saving on entertainment, and avoiding unnecessary purchases.

1. What Are the Best Strategies for Reducing Monthly Utility Bills?

I started by adjusting my thermostat settings. Keeping it at 68°F in winter and 78°F in summer cut my heating and cooling costs by about $40 each month.

Switching all my light bulbs to LED versions made a big difference. LEDs use 75% less energy and last much longer.

I unplug electronics when I’m not using them. Devices like coffee makers, TVs, and phone chargers still draw power when plugged in, so this simple habit saves me around $15 monthly.

I also called my utility company to ask about budget billing plans. Spreading costs evenly throughout the year makes bills more predictable.

2. How Can Meal Planning Lead to Significant Savings on Groceries?

I plan my meals every Sunday for the entire week. This helps me buy only what I need and avoid impulse purchases.

Before shopping, I check what’s already in my fridge and pantry. Building meals around those ingredients prevents food waste.

I make a detailed shopping list organized by store sections. Staying focused at the store keeps me away from expensive aisles.

Cooking larger portions and eating leftovers for lunch helps me save money. I rarely need to buy lunch at work.

Buying generic brands instead of name brands saves me about $60 per month. For basics like rice, pasta, and canned goods, the quality is usually the same.

3. What Tips Can Help Lower Transportation Costs Without Impacting My Daily Commute?

I combine multiple errands into one trip whenever possible. This reduces gas usage and saves time.

Carpooling with a coworker twice a week helps me cut fuel expenses by 20%. We split gas costs and take turns driving.

Checking tire pressure monthly and keeping up with regular car maintenance keeps my car running efficiently. Proper tire pressure improves gas mileage, and maintenance prevents costly repairs.

I use a gas app to find the cheapest stations along my route. Sometimes, the price difference is as much as 20 cents per gallon.

For trips under two miles, I walk or bike. This saves gas and helps me stay active.

4. Can Subscription Services Be Streamlined to Cut Down Recurring Charges?

I made a list of all my subscription services. I discovered I was paying for streaming, apps, and memberships I barely used.

Canceling three streaming services and keeping only my favorites saved me money. If something specific catches my eye, I can always resubscribe for a month.

Switching from monthly to annual payments for services I use regularly also helps. Many companies offer discounts for yearly subscriptions.

Setting calendar reminders before free trials end prevents unwanted charges. I avoid paying for services I don’t want to continue.

Sharing family plans with relatives for music streaming and cloud storage is another great hack. We split the cost, so everyone saves.

5. How Can I Save Money on Entertainment Without Sacrificing Fun and Relaxation?

I look for free community events like outdoor concerts, festivals, and library programs. These activities are just as enjoyable as expensive entertainment options.

Hosting movie nights at home with popcorn and friends is a favorite of mine. It’s more social and costs much less than going out.

I take advantage of happy hour specials and restaurant deals. Many places offer discounts during off-peak hours or on certain days.

My local library is a goldmine for books, movies, and even museum passes. Many libraries loan items for free that would cost money elsewhere.

Outdoor activities like hiking, picnics, and beach visits are always on my list. Nature offers endless free entertainment and keeps me healthy.

What Are Effective Ways to Minimize Unnecessary Shopping Expenses?

Try the 24-Hour Rule

Whenever I want to buy something over $50, I wait 24 hours. This pause gives me time to consider if I truly need it.

Make a Shopping List and Stick to It

Before I head out or shop online, I write a list. I only buy what’s on it, which keeps me focused and avoids extra spending.

Remove Temptation

I unsubscribed from store emails and deleted shopping apps from my phone. With fewer tempting offers, I find it easier to avoid impulse purchases.

Invest in Quality Over Quantity

I choose quality items that last longer. This approach saves me money because I don’t have to replace things as often.

Shop Your Own Closet

Before buying new clothes, I look through my closet. I often rediscover forgotten pieces or create new outfits from what I already have.By using these simple strategies, you can keep your spending in check and make your money work for you. Give them a try and see the difference in your budget!