Let’s be honest—your 30s are where things get real in your financial journey. In your 20s, you’re mostly figuring things out, and by your 40s, a lot of big choices are already behind you. But your 30s? This is the sweet spot. You’ve got enough time to recover from mistakes, but also enough life experience to know what’s at stake.

This is the decade where smart financial moves can really set you up, while missteps might haunt you for years. Most of us juggle a crazy mix of student loans, mortgages, family expenses, and that sneaky lifestyle inflation that comes with a bigger paycheck. The median net worth for folks in their 30s hovers around $35,000, but if you play your cards right, you can blow past that.

The way you handle budgeting, investing, and debt now will ripple through the next 30 years. Whether you end up thriving or struggling often comes down to how you handle the unique curveballs this decade throws at you.

Key Takeaways

- Your 30s are prime time for building wealth—you’ve got earning power and time on your side.

- Don’t let lifestyle creep eat your progress; use tax-advantaged accounts like 401(k)s and IRAs to build your foundation.

- Emergency funds, smart debt management, and solid insurance can keep nasty surprises from wiping out your progress.

Laying Your Financial Foundation

The habits you build in your 30s can carry you for decades. I remember hitting 30 and realizing I needed to actually track my money—not just hope for the best.

Start by figuring out where you stand. Set goals that matter to you, and map out a plan that feels doable (not overwhelming).

Assessing Your Financial Health

Before you dream up a financial plan, get a handle on your current situation. This is your starting line.

Net worth is your scoreboard. Just total up your assets and subtract your liabilities.

| Assets | Liabilities |

|---|---|

| Savings accounts | Credit card debt |

| Investment accounts | Student loans |

| Home value | Mortgage balance |

| Car value | Auto loans |

Track your income and expenses for at least a month. It’s eye-opening (and sometimes a little painful).

I always check my credit score and scan my report once a year. If you’re above 700, you’ll snag better rates on loans. Errors can mess you up, so don’t skip this.

Debt-to-income ratio matters too. Try to keep all your monthly debt payments under 36% of your gross income.

Establishing Clear Financial Goals

Your 30s come with a pile of financial responsibilities—think home buying, starting a family, or maybe just keeping your head above water.

Short-term goals (1-3 years) could be:

- Building a 6-month emergency fund

- Killing off high-interest credit cards

- Saving for a home down payment

Long-term goals (5+ years) might look like:

- Retirement nest egg

- Kids’ college funds

- Paying off your mortgage

The SMART framework helps here. Specific, Measurable, Achievable, Relevant, and Time-bound. Don’t just say “save for a house”—say “Save $15,000 for a down payment by December 2026.” That’s how you keep yourself honest.

Write your goals down. Check in every few months. Life shifts, so your goals probably will too.

Building Your First Financial Plan

A real financial plan links what you have now to where you want to go. In your 30s, it’s easy to feel pulled in a million directions.

Try the 50/30/20 rule:

- 50% for needs (housing, groceries)

- 30% for wants (nights out, fun stuff)

- 20% for savings and debt

Make your emergency fund a top priority. Shoot for 3-6 months of expenses in a high-yield savings account.

Tackle debt next. The avalanche method goes after high-interest stuff first, saving you the most. The snowball method starts with small balances, which can feel more motivating.

Automate as much as you can. Set up automatic transfers for:

- Emergency fund

- Retirement accounts

- Bills

- Investments

Review your plan at least once a year or after big life changes. Marriage, new job, new baby? Time for a check-in.

This structure gives you security, but you can flex as life throws you curveballs.

Mastering Budgeting and Managing Expenses

In your 30s, you need more than just “don’t spend too much.” It’s about making your money work for you. I’ve found that having the right tools and a little discipline can make all the difference.

Creating a Realistic Budget

The 50/30/20 rule is a great place to start. Half your after-tax income goes to essentials, 30% is for fun, and 20% is for savings and debt.

But honestly, sometimes life doesn’t fit neat percentages. If your rent is sky-high, maybe you tweak it to 60/20/20.

Zero-based budgeting is for the detail-oriented. Every dollar gets a job before the month starts. Nothing just drifts.

Priority-based budgeting? Focus on your top goals first. If building your emergency fund is key, cut back elsewhere until you hit your target.

Pick a method that fits your style. Review it each month, see what’s working, and don’t be afraid to adjust.

Tracking Spending Habits

You can’t fix what you don’t track. Most of us underestimate our spending—by a lot.

Daily expense tracking has opened my eyes to where my money really goes. Those $5 coffees? They add up.

Try the envelope method if you’re a visual person. Cash goes in envelopes for each category. When it’s gone, it’s gone.

Look over your bank and credit card statements for the last few months. Patterns will jump out at you—sometimes in a good way, sometimes not.

Impulse buys are budget killers. I try to wait 24 hours before buying anything non-essential. It’s saved me from a lot of regret.

Spot your weak spots. For me, it was food delivery and streaming services. What’s yours?

Using Financial Tools and Apps

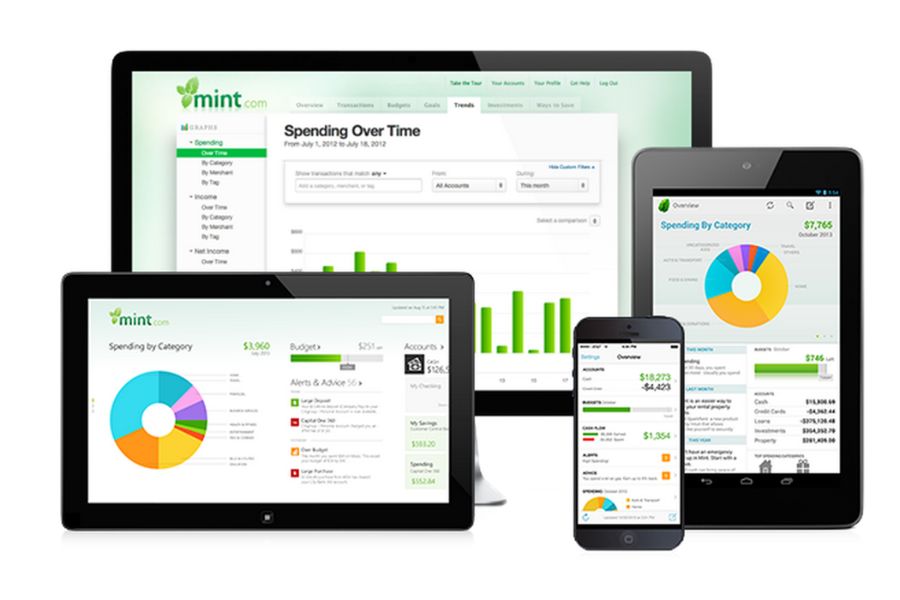

Mint links up to your accounts and lays out your spending in colorful charts. Super easy, totally free.

YNAB is for people who want to assign every dollar a mission. It costs a bit, but the control is next-level.

Spreadsheets are perfect if you want to customize everything. Google Sheets and Excel have templates that sync across devices.

| Tool Type | Best For | Cost |

|---|---|---|

| Mint | Automatic tracking | Free |

| YNAB | Active budgeting | $14/month |

| Spreadsheets | Full control | Free |

Most bank apps now have built-in budgeting tools. Set alerts for when you’re about to overspend.

Automation is your friend. Set up transfers to savings before you even see the money in your checking account.

The best tool is the one you’ll actually use. Don’t get caught up in fancy features if you’ll never open the app.

Building Savings and Emergency Reserves

Let’s talk savings. In your 30s, you’re probably juggling a bunch of goals, but building up your reserves is non-negotiable. I learned this the hard way when my car broke down and I wasn’t prepared.

Prioritizing an Emergency Fund

An emergency fund is your financial airbag. Most experts say aim for three to six months of living expenses—think $35,000 for a typical household, but your number may vary.

Start by adding up your must-pay bills: rent or mortgage, utilities, groceries, insurance, and minimum debt payments. Multiply by three for a basic cushion, or by six if you want more peace of mind.

Stick your emergency fund in a high-yield savings account. Online banks and credit unions usually have the best rates.

Building this fund takes time. I started with a $1,000 mini emergency fund and chipped away at it. Small, regular deposits really add up.

Short-Term and Medium-Term Saving Goals

Besides emergencies, you probably have other things you’re saving for. It helps to break these down.

Short-term goals (1-2 years) might be:

- Vacation fund

- Car repairs or replacement

- Holidays

- Small home upgrades

Medium-term goals (3-5 years) could include:

- House down payment

- Wedding

- Starting a family

- Career changes

Match your saving strategy to your goal. Short-term? Keep it liquid in a high-yield account. Medium-term? Maybe CDs or conservative investments.

Prioritize what matters most. Separate accounts for each goal make it easier to track and avoid “accidentally” spending your down payment on a trip to Bali.

Automating Your Savings

Automation is the lazy genius’s secret weapon. When savings happen automatically, you don’t have to think about it—or talk yourself out of it.

Set up auto-transfers from checking to savings right after payday. Treat it like a bill you can’t skip.

If your job offers a 401(k), jump on it. Employer matches are free money. You’ll barely notice the money missing from your paycheck, but your future self will thank you.

Apps can help too. Some round up your purchases and save the change. Others analyze your spending and stash away extra cash when you can afford it.

Start small if you need to. The habit is what matters. As your income grows—or your expenses drop—increase your savings rate.

Strategic Debt Management in Your 30s

Debt can feel like a ball and chain, but your 30s are the time to break free. How you handle debt now shapes your future options—buying a home, saving for retirement, or just sleeping better at night.

Paying Off High-Interest Debt First

High-interest debt, especially credit cards, is the enemy of progress. Those 18-29% interest rates are brutal.

The Debt Avalanche Method attacks the highest interest rates first. You save more this way, even if it feels slow at first.

The Debt Snowball Method goes for the smallest balances. It’s motivating to see quick wins, and sometimes that’s what you need to stay on track.

| Method | Focus | Best For |

|---|---|---|

| Debt Avalanche | Highest interest rate first | Maximum savings |

| Debt Snowball | Smallest balance first | Motivation boost |

I recommend the avalanche for long-term savings, but honestly, whichever one keeps you moving is the right one.

If you’re carrying $15,000 in credit card debt at 22%, you’re burning about $275 a month just in interest. Wipe that out, and you’ll free up cash for the things you actually care about.

Approaches to Student Loans

Let’s be honest—student loans in your 30s can feel like a puzzle you just can’t finish. You have to weigh your options carefully, especially since federal student loans come with perks that private loans just don’t offer.

Federal loan benefits I wish I’d known sooner:

- Income-driven repayment plans

- Public Service Loan Forgiveness

- Deferment and forbearance programs

- Fixed interest rates

You can refinance with private lenders to snag a lower interest rate. But you’ll lose those federal protections and benefits if you go that route.

If you’ve got a steady income and a solid credit score, refinancing might make sense. On the other hand, folks in public service or with unpredictable income should probably stick with federal loans.

Think about refinancing if:

- Your credit score has jumped since college

- Current rates are at least 1-2% lower than your existing loans

- You’ve got stable employment and income

On average, refinancing can shave 1.5% off your interest rate. For a $50,000 loan, that’s about $7,500 saved over a decade—nothing to sneeze at.

Understanding Good Debt vs. Bad Debt

Not all debt is created equal. Knowing the difference helps you figure out which ones to crush first.

Good debt usually:

- Gains value over time

- Offers tax breaks

- Comes with lower interest rates

- Boosts your earning power

Think mortgages, student loans for a better career, or business loans that actually make you money.

Bad debt? It’s got a few red flags:

- High interest (over 10-12%)

- Tied to stuff that loses value

- Lacks tax perks

- Funds consumer spending

Credit card balances from vacations, high-interest car loans, and payday loans? Those are the usual suspects.

People in their 30s should attack bad debt with everything they’ve got, while handling good debt more strategically. A mortgage at 4%? I’d put that behind credit cards charging 24% interest.

Opportunity cost matters here. Every extra dollar you throw at a low-rate mortgage could be earning 7-10% in the stock market instead.

Boosting Your Credit Score

A strong credit score really starts to matter in your 30s. Buying a home or car? You’ll want to land in the 740-850 range for the best deals.

Payment history makes up 35% of your score. Set up auto-payments—you’ll thank yourself later. Just one late payment can tank your score by 60-100 points.

Credit utilization covers 30%. Try to keep card balances under 30% of your limits. If you can keep it under 10%, even better.

Length of credit history matters for 15%. Don’t close your oldest cards, even if they’re gathering dust. That average account age really does count.

Credit mix and new accounts round out the last 20%. Lenders like seeing a mix—cards, loans, maybe a mortgage. But don’t open a bunch of new accounts all at once.

You can bump up your score by paying down balances, asking for higher credit limits, or becoming an authorized user on a family member’s good account.

Most people notice improvements after 3-6 months of good habits. If your credit took a real hit, expect it to take a couple years to fully bounce back.

Investing and Retirement Planning Strategies

Your 30s are kind of a sweet spot. You’ve got more earning power, but you still have time on your side to let compound interest do its magic. The trick is picking the right tax-advantaged accounts and building a portfolio that won’t get wrecked by market swings.

Harnessing Compound Interest Early

Compound interest is honestly the closest thing to magic in finance. Invest a dollar at 30, and it’s got 35 years to multiply before you hit retirement.

If you put away $6,000 a year starting at 30, you’ll end up with about $1.37 million by 65. Wait until you’re 40 to start? That drops to $720,000, even with the same yearly contribution.

Here’s the wild part: your money earns returns on top of returns, not just on what you put in.

Time beats dollar amount, almost every time. If you invest $2,000 a year from 25 to 35 and then stop, you might still have more at retirement than someone who saves $2,000 a year from 35 to 65.

These years are your golden window. Skip them, and you’ll have to save a lot more later to catch up.

Choosing the Right Accounts: 401(k), IRA, and Roth IRA

Which account should you fund first? The order makes a difference for taxes.

Start by maxing your employer’s 401(k) match. Then, look at other tax-advantaged options.

401(k) plans let you stash away up to $23,500 in 2025. Your contributions lower your taxable income, and your investments grow tax-deferred.

Traditional IRAs work similarly, with a $7,000 limit for 2025. Contributions are tax-deductible, and growth is tax-deferred.

Roth IRAs use after-tax money, but you get tax-free withdrawals in retirement. If you think your taxes will be higher later, Roth is a great move in your 30s.

| Account Type | 2025 Limit | Tax Treatment | Best For |

|---|---|---|---|

| 401(k) | $23,500 | Tax-deferred | High earners |

| Traditional IRA | $7,000 | Tax-deferred | Lower current income |

| Roth IRA | $7,000 | Tax-free growth | Future high earners |

High earners who can’t contribute to a Roth directly might want to look into the backdoor Roth strategy.

Building Your Investment Portfolio

In your 30s, you should lean toward growth but keep a dash of stability. Most financial folks say 80-90% stocks, 10-20% bonds is a good starting point.

Index funds and ETFs give you instant diversification for cheap. They track the market, and you don’t have to babysit them.

Target-date funds are a set-it-and-forget-it option. They start out aggressive and get safer as you get closer to retirement.

Stock allocation ideas:

- 60% U.S. stocks (large, mid, small-cap)

- 20% international developed markets

- 10% emerging markets

- 10% bonds or bond funds

Keep your fees low—look for expense ratios under 0.20%. High fees eat into your gains over time.

Robo-advisors are a solid choice if you want automated, professional management without the big price tag. They’ll rebalance and optimize for taxes automatically.

Trying to time the market or pick hot stocks? Honestly, it’s a gamble unless you really know what you’re doing.

Taking Advantage of Employer Match and Tax Benefits

Employer matches are basically free money. A 50% match on 6% of your salary is like getting an instant 3% raise.

Let’s do some quick math: if you earn $70,000 and contribute 6% ($4,200), a 50% match gives you another $2,100 every year. Over 30 years, that match alone could grow to more than $500,000.

Health Savings Accounts (HSAs) are underrated. You get a tax deduction, tax-free growth, and tax-free withdrawals for medical expenses. After 65, you can use HSA funds for anything—just pay regular income tax, like a 401(k).

Tax-loss harvesting in taxable accounts can lower your tax bill. Sell investments that lost value to offset gains from winners.

If you’re in your 30s, maxing out pre-tax contributions can drop you into a lower tax bracket. That’s a big win, especially during your highest earning years.

Once your portfolio grows past $100,000 or things start getting complicated, it’s probably time to talk to a financial advisor.

Protecting Your Financial Future

Your 30s are about building safety nets—think insurance, legal docs, real estate moves, and family planning. These layers protect you from those “life happens” moments while setting you up for future wealth.

Choosing Essential Insurance Coverage

Health insurance is the bedrock. One big medical bill can wipe out years of savings. Aim for a plan with reasonable deductibles and solid preventive coverage.

Disability insurance is a must if you rely on your paycheck. Short-term covers 3-6 months, while long-term keeps you afloat for years if you can’t work.

Life insurance matters when someone else counts on your income. Term life is affordable and covers you for 10-30 years. A good rule? Get coverage equal to 10 times your annual salary.

Auto and home insurance protect your biggest stuff. Don’t skip liability coverage—it shields you from lawsuits. Umbrella policies add extra protection for high earners.

Review your insurance every year. Big life changes—marriage, kids, a new house—mean you’ll need to update your coverage.

Estate Planning Steps

Estate planning isn’t just for the wealthy. A basic will makes sure your stuff goes where you want and names guardians for your kids. Skip it, and the state decides for you.

Trusts offer more control and privacy. Revocable trusts skip probate and let you tweak things as life changes. Irrevocable trusts can cut taxes but lock things in.

You’ll want these documents:

- Will with guardian choices

- Financial power of attorney

- Healthcare directive

- Updated beneficiaries for all accounts

Basic estate planning costs $1,000-$3,000. If you have a complex situation, you’ll need a specialist. Review everything every few years or after big life events.

Homeownership and Real Estate Decisions

Buying a home builds equity, but it takes planning. Save up 10-20% for a down payment and don’t forget about closing costs. Less than 20% down? You’ll pay private mortgage insurance.

Mortgage rates can make or break your budget. Always compare lenders and get pre-approved before you start house hunting. Fixed-rate mortgages keep payments predictable.

Factor in all housing costs:

- Principal and interest

- Property taxes and insurance

- Maintenance and repairs

- HOA fees if you have them

If you want real estate exposure without the headaches, REITs (real estate investment trusts) are worth a look. They’re diversified and easy to buy or sell.

Location is everything. Check out job growth, schools, and local development before you buy.

Planning for Family and Education

Kids change the game financially. Planning ahead saves headaches later. Childcare alone can run $10,000-$20,000 per year, per child.

529 college savings plans let your money grow tax-free for education. Many states toss in a tax deduction, too. The earlier you start, the more you’ll have.

College costs keep climbing. Public schools average $25,000 a year with room and board. Private schools? Over $50,000 annually in many cases.

Don’t forget these family expenses:

- Pregnancy and birth costs

- Childcare or lost income

- Needing a bigger place

- Higher health insurance premiums

A good financial advisor can help you juggle it all—saving for college, retirement, and keeping your financial security intact. Once life gets complicated, getting a pro in your corner is smart.

Frequently Asked Questions

Your 30s come with their own set of money headaches and opportunities. Here’s what people ask most about managing retirement accounts, emergency funds, investments, and debt during this decade.

What are the top financial strategies to employ in your 30s for long-term success?

First, max out your employer 401(k) match. That’s free money—an instant 50% to 100% return, depending on your match.

If you’ve got a high-deductible health plan, contribute to an HSA. Triple tax benefits make it a powerhouse for long-term savings.

Next, fund a Roth IRA for tax-free retirement withdrawals. The 2025 contribution limit is $7,000 if you’re under 50.

Keep your investment portfolio aggressive—80% to 90% in stocks is usually right for this stage. You’ve got decades to ride out the bumps and capture growth.

How can you balance budgeting for immediate needs and saving for the future in your 30s?

Automate your savings so you don’t accidentally spend what you mean to invest. Automatic transfers make sure you stick to your plan.

Try the 50/30/20 rule: half your income goes to needs, 30% to wants, and 20% to savings or debt. It’s a flexible way to cover today and tomorrow.

Build an emergency fund with three to six months of expenses. That way, you won’t have to raid your retirement if an unexpected bill pops up.

If you’re carrying high-interest debt (over 6-7%), pay that off first before investing more. Lower-rate debt can stick around while your investments grow.

What are key financial milestones to aim for by age 36?

Let’s start with net worth. By 30, aim to match your annual income, and by 35, try to double it. The median net worth for folks in their 30s? It’s about $35,649—so if you’re in that ballpark, you’re not alone.

Next up: emergency funds. I’ve found that covering three to six months of living expenses gives me peace of mind. It’s not just a rule—it’s a cushion that keeps surprises from wrecking your plans.

Retirement savings matter, too. By your mid-30s, shoot for a retirement account balance equal to one or two times your yearly salary. I usually recommend putting away 10% to 15% of your income; it’s doable, and the consistency really adds up.

Keep an eye on debt. Try to keep your total debt payments below 36% of your income, including the mortgage if you have one. Personally, I get nervous if consumer debt creeps above 20% of my gross income—so I try to keep it well below that.

Is experiencing financial challenges common in your 30s, and how can you overcome them?

Honestly, yes—your 30s can feel like a financial roller coaster. Big life events happen fast: marriage, buying a house, maybe starting a family. These milestones often hit right as your earning power climbs.

Student loans? They’re still hanging around for many of us. Most people I know in their 30s carry balances between $30,000 and $50,000. Mortgages are even bigger—think $200,000 to $350,000, depending on where you live.

The good news? Your income usually grows, too. The median for this decade sits somewhere between $59,000 and $70,000 a year.

Here’s a tip I wish I’d learned sooner: don’t let lifestyle inflation eat your progress. If you get a raise or a bonus, try to save at least half. It’s tempting to upgrade everything, but holding back keeps your momentum strong.

What investment advice can maximize your savings by the time you reach retirement?

Start investing early—seriously, it makes a huge difference. Compound growth over 30+ years is like magic. A $1,000 investment at 30 grows much more than the same amount at 40. I’ve seen it firsthand.

Max out your 401(k) if you can swing it. The 2025 limit is $23,500, and it comes with nice tax perks. Lower taxes now, more wealth later? That’s a win-win.

Don’t put all your eggs in one basket. I like broad market index funds and total stock market ETFs. They let you diversify instantly and keep fees low.

Remember to rebalance your portfolio every year. I know it’s not exciting, but it keeps your investments on track. Selling what’s done well and buying what’s lagged can actually boost your long-term returns.

How can you develop a financial plan in your 30s that will withstand economic fluctuations?

Build Multiple Income Streams

Let’s be honest—relying on just one paycheck feels risky these days. I’ve watched friends lose jobs overnight, and it’s rough. So, I started exploring side gigs, like freelance work and investing in rental properties. Even small steps, like picking up dividend-paying stocks, can make a difference. The more income sources you have, the less you’ll panic if one dries up.

Don’t Skimp on Insurance

Insurance isn’t exciting, but it’s saved me from disaster more than once. If you’ve got people counting on you, life insurance is a must. And if you’re like me, worried about what would happen if you couldn’t work, disability insurance is worth every penny. It’s about protecting what you’ve built.

Set Flexible Savings Goals

Life throws curveballs, especially when the economy acts up. I keep separate savings for short-term needs and long-term dreams. This way, I can tap into the right bucket when something unexpected happens. You don’t have to have it all figured out—just start with what you can and adjust as life changes.

Stay Consistent With Investing

Trying to time the market? I’ve tried and, honestly, it’s stressful and rarely works out. I stick to regular contributions, even when things look shaky. Over time, this habit beats jumping in and out based on headlines. It’s not flashy, but it works.Building a financial plan in your 30s isn’t about perfection. It’s about creating options, protecting yourself, and making steady progress—even when the world feels unpredictable.