Let’s be honest—banks want your business, and they’re not shy about showing it. Right now, you can walk away with $200, $500, or sometimes even more, just for opening a new account and checking a few boxes. I’ve seen these offers get more generous over the years as banks try to outdo each other and grab your attention.

If you’re willing to switch banks, you can snag $500 or more. All you need to do is open a qualifying account and complete some basic steps, like setting up direct deposit or keeping a certain minimum balance. It’s not rocket science. You just need to know where to look, pick a bank that fits your style, and follow their rules before the clock runs out.

Savvy bank hoppers know how to play the game. They hunt for bonuses that match their habits and plan their moves so they never leave money on the table.

Key Takeaways

- Banks pay up to $500 (sometimes more) when you open a new account and meet their terms.

- To actually get the bonus, you’ve got to pay attention to deposit minimums, set up direct deposit, and watch the calendar.

- Don’t forget about taxes and fees—those can eat into your bonus if you’re not careful.

How Bank Welcome Bonuses Work

Banks dangle sign-up bonuses as bait to reel in new customers. You’ll see offers from $50 up to $500, and even higher if you’re eyeing premium accounts.

What Are Bank Bonuses?

Think of bank bonuses like credit card welcome offers, but usually simpler. Banks want you to ditch your old account and bring your business to them, so they’ll pay you for it.

Here’s how it usually goes: open an account, jump through a few hoops (like direct deposit), and the bank drops bonus cash right into your account. Pretty straightforward.

Typical bonus ranges:

- Basic accounts: $50-$200

- Premium accounts: $300-$500

- Business accounts: $500-$2,000

Banks usually run these promos for a limited time. Sometimes you’ll need a promo code or have to live in a certain area to qualify.

Types of Eligible Accounts

Most bonuses target checking accounts. Why? Because that’s where banks make money from your everyday transactions.

Savings account bonuses exist, but you don’t see them as often. Banks want you using checking accounts for direct deposits and bill payments.

Some banks will pay you extra if you open both checking and savings accounts together. They’re hoping you’ll stick around longer.

Premium accounts? Those come with bigger bonuses, but you’ll need to park more money there.

Occasionally, you’ll see signup bonuses for money market accounts or CDs, but those are rare.

How to Qualify for a Bonus

Most banks want you to jump through a few hoops within 60-90 days. That’s usually enough time, but you have to stay on top of it.

Direct deposit is the most common requirement. You’ll usually need one or more direct deposits totaling $500 to $2,000 a month.

Minimum balance rules are all over the map. Some banks want you to keep $1,000, others ask for $25,000, depending on the account.

Other ways to qualify:

- Make a certain number of debit card purchases

- Set up automatic bill pay

- Keep the account open for 90-180 days

You can’t have had an account with that bank in the last year or two, or you’re out of luck.

If you close your account too soon, banks will claw back the bonus—so don’t get reckless.

Step-by-Step Guide to Switching Banks for Bonuses

Switching banks for a bonus isn’t hard, but you do need a plan. You’ll want to check your current accounts, research the best offers, and time everything right so you don’t get hit with extra fees.

Evaluating Your Current Accounts

Before you chase a new bonus, take a good look at your current bank situation. Make a list of the monthly fees, interest rates, and perks you’re getting now.

Hidden costs sneak up on a lot of people. ATM fees, overdraft charges, minimum balance penalties—they add up fast.

Figure out your yearly banking costs. That way, you’ll know if switching banks is worth it, even after the bonus is gone.

Things to check:

- Monthly fees and how to avoid them

- Savings account interest rates

- ATM network and fees

- Customer service and branch locations

- Digital banking features and app quality

It’s also worth asking your current bank if they’ll offer you a retention bonus to stay. Some banks will fight to keep you.

Researching the Best Bonus Offers

Let’s talk numbers. The juiciest bank bonuses run from $200 to $2,000, depending on how much you’re willing to deposit and the type of account.

Big names like Chase, Wells Fargo, and Citi often have the highest checking bonuses.

Focus on offers you can actually qualify for. Most require direct deposits between $500 and $5,000 within a couple of months.

Bonus categories to look for:

- Traditional banks: $200-$500 for checking accounts

- Online banks: $150-$300, usually with fewer hoops

- Premium accounts: $1,000+ if you’ve got big deposits

- Credit unions: $100-$300, often with friendly terms

Online banks like SoFi and Discover usually make it easier. They often skip monthly fees and pay decent interest, too.

Timing matters. Banks tend to roll out bigger bonuses in January and September, so watch for those windows.

Comparing Fees and Account Features

The bonus is nice, but don’t let fees eat it up. Monthly charges can wipe out your gains if you’re not careful.

Most bonus accounts charge $10 to $25 a month, but you can usually dodge these fees with direct deposits or by keeping a certain balance.

Compare these fees:

- Monthly maintenance and waiver rules

- Minimum deposit to open

- ATM fees and network size

- Wire and cashier’s check costs

- Overdraft protection fees

Premium accounts need bigger opening deposits but come with perks like ATM fee refunds and better interest.

Pick accounts where fee waivers match your real-life habits. If you get paid by direct deposit, choose an account that waives fees for that, not just for keeping a high balance.

Transferring Direct Deposits and Payments

This part takes some juggling. Keep both your old and new accounts open for a while so you don’t miss any bills or paychecks.

Direct deposit changes can take a pay cycle or two. Give your payroll department your new info before you close your old account.

Checklist for switching:

- Update payroll for direct deposit

- Move automatic bill payments and subscriptions

- Transfer scheduled payments for utilities and loans

- Change payment info for streaming and memberships

- Redirect government benefits and tax refunds

Most people keep the old account open for 30 to 60 days, just to be safe.

Take screenshots or write down all your recurring payments before you switch. It’s easy to forget one and end up with a late fee.

Banks Offering $500+ Bonus Promotions in 2025

Let’s get to the good stuff. Here are some banks where you can score $500 or more just for switching. Most will want you to set up direct deposit and keep a certain balance for a while.

Bank of America Welcome Bonus

Bank of America is offering a $500 bonus for new checking customers. All you need to do is open an eligible account and set up direct deposits totaling at least $2,000 within 90 days.

You can use payroll, government benefits, or pension deposits to qualify.

Keep your account open and in good standing for 90 days. The bonus usually lands in your account within 60 days after you meet all the requirements.

They’ll waive the monthly fee for the first year, which is a nice touch. After that, you can avoid the fee by keeping a minimum daily balance or sticking with direct deposit.

Chase Private Client and Total Checking

Chase has two big offers right now. Chase Total Checking pays a $300 bonus for new customers.

Chase Private Client Checking is even better, with a $1,000 bonus, but you’ll need to deposit at least $25,000 to qualify.

For both, you’ll need to set up direct deposit within 90 days. Total Checking asks for $500 in direct deposits, while Private Client wants $1,000.

Chase also has a business account with a $500 bonus. You’ll need to deposit $2,000 in new money and make five qualifying transactions.

Monthly fees apply unless you meet their requirements. Total Checking charges $12 a month, but you can avoid it with direct deposit or a minimum balance.

BMO Smart Advantage Checking

BMO’s Smart Advantage Checking comes with a $500 bonus for newbies. They’re targeting folks who are switching from another bank.

You’ll need to deposit at least $4,000 in new money within 120 days. Money from other BMO accounts doesn’t count.

Set up direct deposit for at least four months straight. The bonus hits your account within 120 days after you’ve checked all the boxes.

BMO waives the monthly fee for the first year. After that, keep a $5,000 minimum balance or set up direct deposit to avoid the $15 fee.

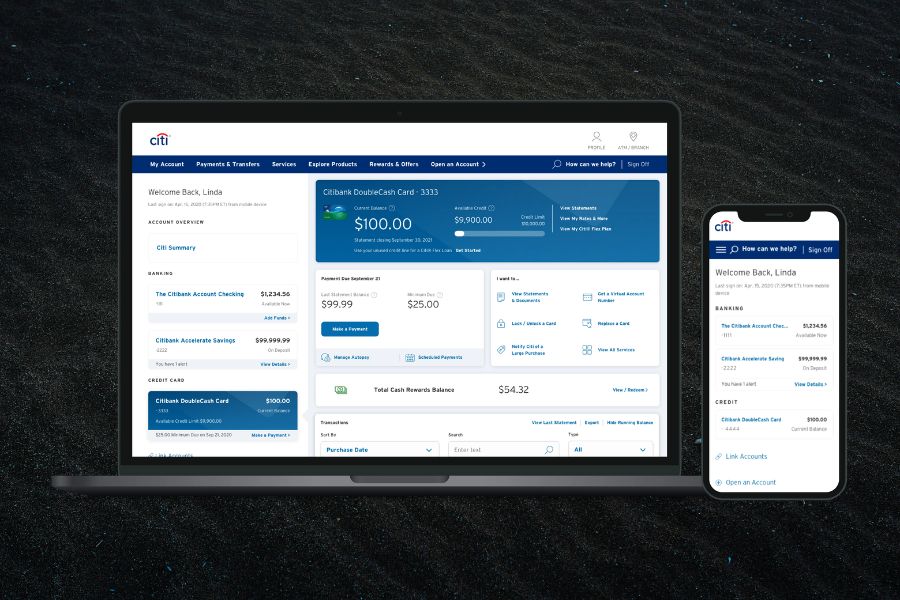

Citibank and PNC Bank Offers

Citibank is giving out a $700 bonus if you open both a checking and savings account. You’ll need to deposit $15,000 in new money within 30 days and keep it there for 60 days.

PNC Bank offers a $500 bonus with their PNC Virtual Wallet account. This combines checking, savings, and budgeting tools.

You’ll need $5,000 in direct deposits within 60 days. Only employer or government deposits count.

Both banks toss in some extra perks, too. Citibank has premium services, while PNC’s Virtual Wallet comes with financial tracking tools.

Common Requirements to Secure a Bank Bonus

To lock in your bonus, you’ll need to jump through a few hoops. Usually, that means setting up direct deposit, keeping a minimum balance, and dodging monthly fees.

Direct Deposit Requirement Details

Most banks want you to set up qualifying direct deposits within 60 to 90 days of opening your account. The minimum is usually $500 to $5,000 a month.

What counts:

- Employer payroll

- Government benefits (like Social Security)

- Pension payments

- Sometimes peer-to-peer transfers (but that’s risky and varies by bank)

What doesn’t count:

- ATM or mobile check deposits

- Wire transfers

- Most person-to-person payments

Most banks want direct deposits from an employer or government agency. Some folks try to get clever with ACH transfers, but banks can reject those.

Timing is everything. Make sure your direct deposits hit within the first 60 to 90 days, or you’ll miss out.

Minimum Balance and Deposit Rules

You’ll usually need to make a minimum opening deposit—anywhere from $25 to $500 for most accounts. Premium accounts might want $1,000 or more.

Typical balance requirements:

- Opening deposit: $25-$500

- Daily minimum: $500-$2,500

- Average monthly: $1,500-$5,000

Some banks want you to keep your balance above a certain level for 30 to 90 days. Drop below, and you could lose the bonus.

A few banks also set a cap on the amount that counts for the bonus, usually between $25,000 and $250,000.

Fee Waiver Strategies

Monthly fees can sneak up on you and eat your bonus if you’re not careful. These usually run $12 to $35 a month.

Best ways to dodge fees:

- Keep a minimum daily balance ($1,500-$5,000)

- Set up direct deposit ($500+ monthly)

- Maintain combined balances across accounts

- Use your debit card for purchases

Banks often give you a grace period—no fees for the first couple of months—so you have time to get everything set up.

Relationship waivers work well if you keep big balances across several accounts. That’s one way to avoid monthly fees for the long haul.

Maximizing Bonus Value: Savings Accounts and High-APY Options

Let’s talk about chasing savings account bonuses and squeezing out every bit of value from high-yield accounts. I’ve seen folks scoop up $300 just for opening the right account, and honestly, it’s hard not to get hooked when APY rates hit 5.00%. These promos usually want you to deposit a chunk of cash and jump through a couple of hoops, but the payoff can be worth it.

Best Savings Account Bonuses

Banks love to dangle bonuses for new savers—think $100, $200, sometimes even $300. They set the bar with requirements like direct deposits or keeping a certain balance.

Here’s what you’ll usually see:

- Direct deposit, often $500–$2,000 a month

- Keeping a minimum balance for 60 to 90 days

If you’re eyeing the bigger bonuses, expect to park $5,000 to $25,000 in the account. The more you deposit, the juicier the bonus.

Some banks get creative and pair savings bonuses with checking account offers. If you play your cards right, you can stack rewards and walk away with $500 or more just for opening both.

Understanding APY and High-Yield Accounts

High-yield savings accounts blow regular ones out of the water. Right now, some online banks—like Varo—offer up to 5.00% APY, although that’s usually capped at a certain balance (like $5,000).

A few things to keep in mind:

- The best rates range from 4.00% to 4.51%

- Online banks almost always beat traditional banks on APY

- When the Fed cuts rates, your APY drops too

Let’s say you stash $10,000 in a 4% APY account. That’s about $400 a year, compared to a measly buck in a regular 0.01% account. It’s wild how much that difference adds up.

I always tell friends: shop around. Even a tiny bump in APY can mean hundreds more in your pocket over time. Long-term earnings really add up.

Combining Checking and Savings Promotions

Banks sometimes bundle offers for opening both checking and savings accounts. I’ve seen these combos push total bonuses over $500.

Bundled promos can mean:

- Bigger payouts than single-account offers

- Simpler banking—everything under one roof

Some banks throw in $300 for savings, then tack on more for checking. Usually, you’ll need to set up direct deposit, keep a minimum balance, and hold both accounts open for a while.

Check the fine print, though. Sometimes, you have to meet requirements for each account separately. That can change how much cash you need to keep on hand.

Important Tax and Account Management Considerations

Bonuses from banks count as taxable income. If you’re juggling several accounts, you’ll want a plan to dodge fees and keep things tidy. I’ve learned the hard way that staying organized is half the battle.

Tax Implications: 1099-INT and 1099-MISC

Banks treat those welcome bonuses as income. They’ll send you a 1099-INT or 1099-MISC by January 31st for anything you snagged last year.

The IRS taxes these just like regular income—anywhere from 10% to 37%, depending on your bracket. So, if you score a $500 bonus, you might owe $50 to $185 in taxes.

Here’s what matters:

- Checking account bonuses usually show up on a 1099-INT

- Savings account bonuses can land on either form

- Some banks skip the form for smaller bonuses, but you still have to report them

- Keep a running list of every bonus you get

I usually stash away 20–25% of each bonus for taxes. It’s not fun, but it beats scrambling in April.

Managing Multiple Bank Accounts

If you’re chasing multiple bonuses, you’ll need a system. Every account has its own rules, and missing one can cost you the bonus—or worse, hit you with fees.

What’s worked for me:

- Track each account’s minimum balance

- Set reminders for direct deposit deadlines

- Watch out for monthly fees and how to avoid them

- Use a spreadsheet to keep it all straight

Most checking accounts want you to set up direct deposit within 60 to 90 days. Savings accounts often make you hold a minimum balance for 6 to 12 months.

Don’t bite off more than you can chew. Opening too many accounts at once can set off fraud alerts or make it tough to keep up with all the requirements.

Tips for Avoiding Pitfalls

It’s surprisingly easy to slip up and lose out on a bonus—or worse, rack up fees. Reading the rules closely saves a lot of headaches.

Here’s what I watch for:

- Closing accounts too soon (usually need to keep them open at least 6 months)

- Missing a direct deposit or deadline

- Letting your balance dip below the threshold

- Opening new accounts during tax season (it gets chaotic)

- Forgetting to update auto-payments after switching banks

Banks claw back bonuses and tack on fees if you bail early. They almost always want you to stick around for at least 180 days after you get the bonus.

Some banks only give bonuses to brand-new customers. If you’ve had an account there in the past year or two, you might be out of luck.

Frequently Asked Questions

Banks roll out sign-up bonuses from $200 to $2,000 for new customers. Usually, you’ll need to set up direct deposits, keep a certain balance, or hit some activity targets.

What steps should I follow to switch to a new bank offering a welcome bonus?

Start by hunting for banks with the best bonuses. Compare the requirements and jot down every automatic payment or deposit tied to your old account.

Open the new account, meet the bonus terms, and reroute your direct deposits and bill payments. Keep your old account open for a billing cycle or two—just in case something slips through.

Once you’re sure everything’s moved over, then you can safely close the old account.

Which online banks offer the best sign-up bonuses with no initial deposit required?

Some online banks hand out bonuses without needing a big upfront deposit. Sometimes, you’ll get $200 to $500 for opening an account with as little as $25 or $100.

Capital One, Chase, and Bank of America often run low-barrier promos. Credit unions sometimes join in with their own offers.

These deals come and go, so it pays to check bank websites often. Online-only banks usually have fewer expenses and can offer bigger bonuses.

What are the requirements to qualify for a $500 checking account bonus?

To snag a $500 bonus, you’ll usually need to set up direct deposits totaling $1,000 to $4,000 in the first couple of months. Most banks count payroll, pension, or government payments as qualifying.

You might also need to hold a daily balance of $1,500 to $25,000 for a set period. Some banks want you to make a few bill payments or debit card purchases, too.

Don’t forget: keep the account open for six months, or you risk losing the bonus. Banks report these on 1099-INT forms at tax time.

How can I obtain an instant bank sign-up bonus without a deposit?

Honestly, true instant no-deposit bonuses are rare. Most “no deposit” deals still want you to put in $5 to $25 to open the account.

Some banks will toss you a quick $25 to $100 for things like enrolling in online banking or downloading their mobile app. These are usually smaller, faster payouts.

For the big bonuses, you’ll always need to deposit money and wait out the promo period.

Are there mobile banking apps that provide bonuses for new account openings?

Yep, digital banks like Chime, Current, and Varo offer bonuses for signing up through their apps. Usually, you’ll get $25 to $200 for setting up direct deposit.

Traditional banks sometimes have mobile-only promos, but they’re often smaller than what you’d get in a branch or online.

Fintech apps love to run short-term referral and sign-up deals. Just make sure they’re FDIC insured before you move your money.

What strategies can maximize my earnings when switching to a bank with a high welcome bonus?

Let’s dive into this—because honestly, who doesn’t want free money just for opening a new bank account? I always start by checking out several bank offers at once. Comparing them side by side helps me spot which bonuses actually make sense for the effort.

I keep my eye on banks that give the biggest bonuses for the least amount of hassle. Why jump through hoops if you don’t have to? If the deposit or activity requirements look doable, I’ll move forward.

Here’s a big one: use real direct deposits from your job or government benefits to qualify. Some folks try to game the system with transfers, but banks catch on. I usually set up automatic transfers too, just to keep my balance where it needs to be—no sense in letting money sit idle if I don’t have to.

Ever thought about opening more than one account? It sounds a bit wild, but I’ve opened accounts at different banks within a few months and grabbed several bonuses at once. Just be sure to track all those requirements and deadlines. I keep a spreadsheet, but sticky notes work too if that’s your style.

Don’t forget about closing accounts. I always plan ahead to dodge those early termination fees—they can eat into your bonus fast. Timing is everything.

Believe it or not, some people pull in $1,000 to $2,000 a year just by churning through these bank bonuses. It takes a little organization and patience, but the payoff can be pretty sweet. Why not give it a shot?