Let’s be honest: most of the passive income advice floating around online feels outdated, or worse, just plain misleading. After years of trying out dozens of so-called “passive” strategies, I’ve realized only a select few actually put money in your pocket without turning into another full-time job. Here’s the real deal—only seven passive income streams consistently pay off without eating up all your free time. Meanwhile, five popular methods that everyone hypes up? They’re just energy drains that can wipe out your savings and motivation.

I’ve personally hit $15,000 per month with the right strategies. But wow, I’ve also wasted months chasing duds. If you want to skip those expensive mistakes and focus on what really works for 2025, you’re in the right place.

Key Takeaways

- Only a handful of passive income methods actually work without constant hustle.

- Many “passive” ideas are either scams or just way too hands-on to count as passive.

- The best passive income streams? Low startup costs, a proven track record, and minimal maintenance once you get going.

What Makes an Income Stream Truly Passive?

People throw around the term “passive income” so loosely. Most confuse busy work with real passivity. Once you’ve set up a true passive stream, it should need barely any daily effort.

Defining Passive Income

Passive income means money rolls in with little to no ongoing work after the initial setup. For me, real passive income keeps earning while I’m asleep, at my day job, or out traveling.

The best strategies have three things in common. They generate money on autopilot. They need almost no maintenance. And they don’t make you swap hours for dollars every day.

Some genuinely passive examples:

- Dividend stocks that pay out every few months

- High-yield savings accounts that just quietly earn interest

- Rental properties (if you let a manager handle the headaches)

- Royalties from books or music

A lot of “passive” streams are really just side hustles in disguise. They need regular work to keep the money coming.

Evaluating Time and Effort Required

I judge how passive something is by looking at three things: how long it takes to set up, how much daily effort it needs, and how many hours I spend each month just keeping it running.

Setup time can be quick or drag on forever. Buying dividend stocks? That’s a few clicks. Writing a book to earn royalties? That can take months of your life.

Daily involvement is the real test. If you have to check on it every day or constantly answer emails, it’s not passive.

Monthly maintenance should be under 5 hours. That’s just reviewing statements, paying a bill, or a little bit of upkeep.

| Income Type | Setup Time | Daily Work | Monthly Hours |

|---|---|---|---|

| Dividend ETFs | 1 hour | 0 minutes | 30 minutes |

| Blog monetization | 200+ hours | 60+ minutes | 10+ hours |

| REIT investing | 2 hours | 0 minutes | 1 hour |

Common Misconceptions About Passive Income

One of the biggest myths? That passive income streams start making money right away. Most real options need months, sometimes years, before you see anything meaningful. Another common mistake: thinking you don’t need any money upfront. In reality, you’ll usually have to invest something—whether it’s cash for stocks or time to create a product.

“Set it and forget it” is a fantasy. Even the most hands-off streams need occasional check-ins. Bank rates change. Tenants leave. Companies cut dividends. A lot of online “passive income” ideas are just straight-up jobs. Making courses, running YouTube channels, or managing affiliate sites means you’re always creating new content.

The promise of getting rich quick lures people into fake schemes. Building real wealth through passive income takes patience and a realistic outlook on returns.

7 Passive Income Streams That Actually Work

Here’s my list of seven proven passive income streams that can bring in actual cash with little daily work once you get them set up. Each one has its own startup costs and time commitments, but I’ve found them to be the most reliable.

1. Dividend Stocks and Reinvestments

Dividend stocks pay me regular cash just for holding shares. Companies like Coca-Cola and Johnson & Johnson have paid out for decades.

I stick with dividend aristocrats—those companies that have bumped up their payouts for 25+ years. You usually get 2-4% annually from these.

How I approach dividends:

- I reinvest all dividends automatically.

- I buy more shares during market dips.

- I spread my investments across different sectors.

Compound growth is the magic here. If you put in $10,000 at 4% and keep reinvesting, you could have over $21,000 in 20 years.

I love dividend-focused ETFs like VYM or SCHD for instant diversification. These funds hold tons of dividend stocks and charge super-low fees.

Most brokers let you start with just $100. The income grows slowly at first, but compounding kicks in over time.

2. Real Estate Rentals for Consistent Cash Flow

Rental properties can bring in monthly rent while you build up equity. I’ve collected rent checks and watched my property values climb.

Single-family homes in up-and-coming areas are a solid bet for beginners. I look for places where the monthly rent is about 1% of the purchase price.

What I always check:

- Is it close to jobs and good schools?

- What’s the property’s condition and repair history?

- How’s the local rental demand?

- Are there good property management options?

You’ll need $20,000–$50,000 for a down payment, usually. Don’t forget to budget for repairs, vacancies, and management fees.

If you want something easier, REITs are a great alternative. They own income properties and pay out most of their profits as dividends. You can buy REIT shares just like stocks, no landlord headaches.

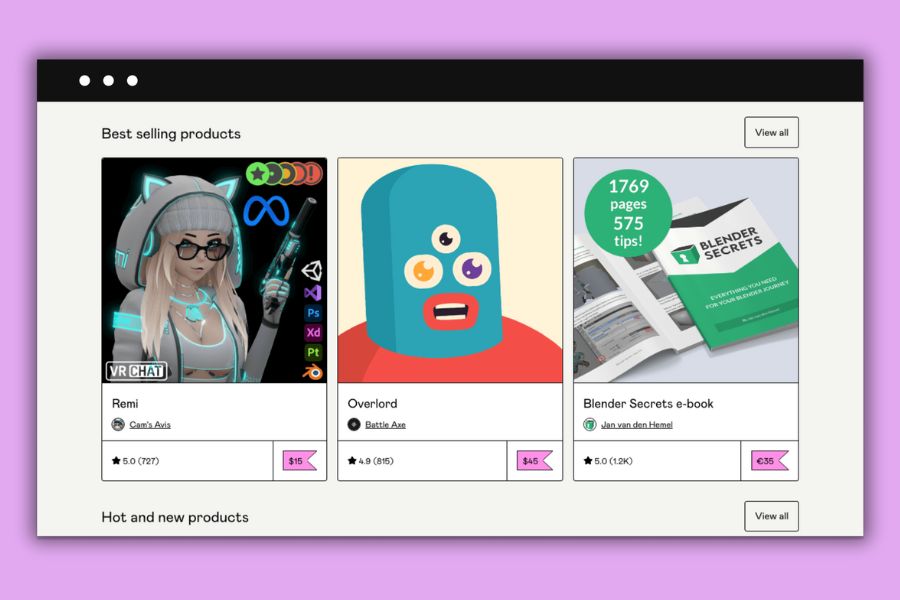

3. Digital Products Like Courses and Templates

Digital products can sell over and over without any shipping or inventory. I’ve created a few and watched the money trickle in for years.

Online courses are awesome if you’ve got skills people want to learn. Platforms like Teachable and Thinkific handle payments and delivery for you.

Popular digital products:

- Video courses on niche skills

- Business document templates

- Ebooks and guides

- Stock photos and graphics

Templates are easier than courses. I make spreadsheets or design files that solve everyday problems.

The trick is to solve a real pain point. I always research what my audience needs before creating anything.

Sales start slow, but a hit product can pull in $1,000–$10,000 a month after some momentum. Social media and email lists help drive sales.

4. Affiliate Marketing with Automated Funnels

Affiliate marketing pays you for promoting other people’s products. I earn commissions when someone buys through my links.

Automated funnels do the heavy lifting 24/7. I create content that attracts my audience and nudges them toward buying.

My affiliate marketing process:

- Blog posts with targeted keywords

- Email sequences to build trust

- Honest product reviews

- Social content to drive traffic

I only promote stuff I actually use. People can tell if you’re faking it, and trust boosts your conversions.

High-ticket affiliate programs pay $100–$1,000 per sale. Software, courses, and business services usually have the best payouts.

You’ll need 6–12 months of steady content before you see real money. But once the traffic comes, old posts and emails keep earning on autopilot.

5. Content Monetization Through Social Platforms

Social platforms make it easier than ever to earn from your content—even if you’re not posting daily. YouTube, for example, keeps paying ad revenue on old videos that people still watch.

I’ve seen creators pull in $500–$2,000 a month from tutorials they uploaded years ago. The secret? Make searchable content that solves a problem.

Instagram and TikTok creators cash in with:

- Brand deals that run on autopilot

- Affiliate links in their bios

- Digital product sales

- Course promotions

Pick one platform and stick to a niche you know well. I recommend making at least 20–30 solid pieces of content before expecting any real income.

Most creators spend a few months building up before the passive money starts rolling in.

6. Micro-SaaS and Notion Templates

Small software tools and templates are exploding right now. Notion templates, for example, can sell for $5–$50 each—and there’s zero shipping or inventory.

Hot template ideas:

- Budget trackers ($15–$25)

- Project management systems ($20–$40)

- Content calendars ($10–$20)

- Goal planners ($5–$15)

Create one good template and sell it hundreds of times. I know folks making $1,000–$3,000 a month from just a handful of digital products.

Micro-SaaS tools—think simple calculators or automation scripts—can bring in $500–$5,000 monthly. You’ll need some tech skills or a developer buddy.

Plan on 20–40 hours to make a solid template or tool.

7. Subscription-Based Communities

Paid communities on Discord, Circle, or Skool can bring in steady monthly income. Members pay $10–$100 a month for access to exclusive content and networking.

Success comes from real expertise in your field. Popular topics include:

- Investing and trading ($30–$50/month)

- Freelancing tips ($15–$30/month)

- Fitness coaching ($20–$40/month)

- Business networking ($25–$75/month)

Start out by getting 20–30 engaged members. Offer weekly value—maybe exclusive content, live Q&As, or member spotlights.

Most owners spend 2–4 hours a week keeping things lively. As the community grows, members start creating their own value and discussions.

Give it 6–12 months to build up to 100+ paying members.

5 Passive Income Streams That Don’t Work (And Why)

Some passive income ideas sound amazing but just don’t deliver. These either need constant effort, have way too much competition, or promise crazy returns that never happen.

1. Stock Photography and Footage Sales

I’ve tried stock photography. Honestly, it’s brutal. The market is packed with millions of photos and videos.

Big sites like Shutterstock pay next to nothing:

- Photos: $0.25–$0.38 per license

- Videos: $1.88–$3.00 per clip

- Extended licenses: $1.88–$28.00

You’d need thousands of downloads for just $100. Most photographers barely clear $50 a month after uploading hundreds of images.

Platforms reject tons of photos for technical flaws or copyright issues. I’ve spent hours editing, only to get turned down.

The competition is wild:

- Pros with expensive gear

- AI-generated images

- Millions of existing photos

New contributors barely get noticed. Your work gets buried under established sellers.

2. Generic Dropshipping Stores

Dropshipping is not passive. I learned that the hard way after running a few stores that fizzled out fast.

You’re always handling customer service, chasing suppliers, and running ads. Returns and complaints are a daily headache. Suppliers run out of stock or jack up prices without warning.

Here’s where the money goes:

- Facebook ads: $500–$2,000+ a month

- Store fees: $29–$79 monthly

- Payment processing: 2.9% + $0.30 per sale

- Returns and refunds: 15–30% of orders

Margins are razor-thin. Most products only net 10–20% before ads. After ad costs, lots of dropshippers lose money.

Getting new customers keeps getting harder. Facebook ad prices have tripled since 2019.

Stores selling random products do the worst. People don’t trust stores that look like a junk drawer.

3. Low-Quality Digital Product Marketplaces

Sites like Etsy and Gumroad are flooded with low-effort digital products. I see the same boring templates and planners over and over.

Stuff that flops:

- Plain PDF planners with nothing unique

- Generic business templates

- Cheap printables with bad design

- Repackaged free content

It’s a race to the bottom. Sellers drop prices to $1–$5, making it nearly impossible to earn real money.

Standing out takes serious marketing. Without a social media following or email list, your products just get lost.

Quality takes work. Making digital products that sell consistently is as hard as building any other business.

Most sellers make under $100 a month. The top 1% get all the sales, while the rest barely break even.

4. Overhyped Make Money While You Sleep Schemes

Some passive income ideas promise easy money, but they’re all hype. I’ve dabbled in a bunch and found they need constant work or pay pennies.

Big offenders:

- Print-on-demand t-shirts (market is way too crowded)

- Affiliate marketing with no audience

- Basic e-books on generic topics

- Low-effort YouTube channels

Print-on-demand is a bloodbath. Your designs compete with millions. Without heavy marketing, you might sell one shirt a month.

Affiliate marketing won’t work if nobody’s listening. Just posting links doesn’t bring sales. Building trust takes time and effort.

Most “passive” ideas need real work up front. If you think you can “set it and forget it,” you’re in for a letdown. Every income stream needs some love and regular tweaks.

Frequently Asked Questions

Everyone seems to have the same burning questions about kicking off passive income streams. Whether you’re just starting out, feeling creative, or hoping to build something with little to no cash, I’ve been there. Let’s dive in.

What are some effective strategies for beginners to create passive income?

Honestly, I’d say start simple. I opened a low-cost index fund with just a hundred bucks and watched it earn a steady 2-4% a year. It’s not flashy, but it works.

Affiliate marketing is another easy win. I promoted stuff I already used on Instagram and made $50 in two months. Not life-changing, but hey, it was real money.

Digital products like ebooks or mini-courses can be surprisingly effective. My first PDF guide about a hobby brought in $300 in just a month.

Don’t forget high-yield savings accounts. They’re not exciting, but I love knowing my money’s growing at 4-5% without me lifting a finger.

Can you provide a list of 50 creative passive income ideas suitable for a variety of interests?

Here’s a mix of ideas—some I’ve tried, some I wish I had more time for:

Digital Products: Sell stock photos. Build a mobile app. Design printables. Launch an online course. Write an ebook. Create software tools. Make website themes.

Content Creation: Start a YouTube channel. Write a blog. Launch a podcast. Make TikToks. Design Instagram templates.

Investment Options: Buy dividend stocks. Invest in REITs. Purchase bonds. Try peer-to-peer lending. Stake cryptocurrency.

Real Estate: Rent out a spare room. Buy a rental property. Try real estate crowdfunding. Lease parking spaces. Rent storage space.

Business Ideas: Create subscription boxes. Build affiliate websites. Start a dropshipping store. License an idea. Launch a membership site.

Creative Ventures: Sell art prints. Design t-shirts. Collect music royalties. Write stock music. Create fonts. Sell craft patterns.

Service-Based: Build an email list. Offer software as a service. Rent out equipment. License your photos. Sell stock videos.

How is it possible to generate passive income without any initial investments?

I started my first income stream using free blogging platforms and affiliate links. Three months in, I’d earned $150—without spending a dime.

Social media’s a goldmine if you’re willing to put in the hours. I know people who pull in $500 a month just by recommending their favorite products on Instagram.

Apps like Rakuten pay for the shopping you’re already doing. I pocketed an extra $20-50 a month with zero effort.

YouTube doesn’t cost anything to start—just your phone and some patience. My first ad revenue trickled in after six months of posting basic videos.

Referral programs are another easy win. Last year, I made $300 just by sending friends signup links for stuff I already used.

Which investment options offer the advantage of a stable monthly income?

Dividend stocks pay me like clockwork. With about $50,000 invested, I bring in $200-500 each month from solid companies.

REITs are a favorite of mine for monthly or quarterly payouts. My $40,000 in REITs nets me around $300 every month.

High-yield savings and CDs are as safe as it gets. My $25,000 emergency fund earns $100 monthly right now.

Bond ladders are great if you like predictability. I built a $30,000 treasury bond ladder that pays out $80 a month.

Rental properties? If you’re up for it, my duplex brings in $800 profit monthly after covering all the bills.

What are some viable passive income opportunities tailored to young adults?

I kicked things off with Acorns at 22, just rounding up spare change. That small start led to $400 in passive income my first year.

Younger folks are crushing it on TikTok and Instagram. I’ve seen 20-somethings pull in $1,000 a month with brand deals.

Selling digital study guides is smart if you’re in school. I made $600 just turning my class notes into PDFs.

Crypto staking is riskier, but I’ve seen 5-8% annual returns on stable coins.

Starting a dropshipping or print-on-demand shop doesn’t take much cash. My friend launched a t-shirt business for under $200 and never looked back.

What are some smart passive income avenues that require minimal upfront monetary commitment?

Affiliate marketing? You really just need a website or even a social media account to get started. I grabbed a domain for $15 and, honestly, I’m now pulling in around $400 a month just by recommending software tools I actually use.

Print-on-demand products are another easy win. There’s no upfront cost—platforms like Redbubble take care of the printing and shipping headaches. You keep 10-20% of every sale, which adds up faster than you might expect.

If you enjoy writing, Medium’s Partner Program can be surprisingly rewarding. I write about topics I genuinely care about, and I see about $150 a month roll in. It’s pretty motivating to get paid for sharing your thoughts.

Building an email newsletter feels a bit old-school, but it works. I used free platforms to grow a list of 1,000 subscribers, and sponsorships now bring in around $200 each month. It’s wild how direct and personal email can be.

Got a camera or even just a decent smartphone? Selling stock photos is a real option. I upload around 10 photos every week, and the licensing fees usually add up to about $80 a month. It’s not life-changing money, but it’s a nice bonus for something I already enjoy doing.